Best Crypto Exchanges with Low Fees

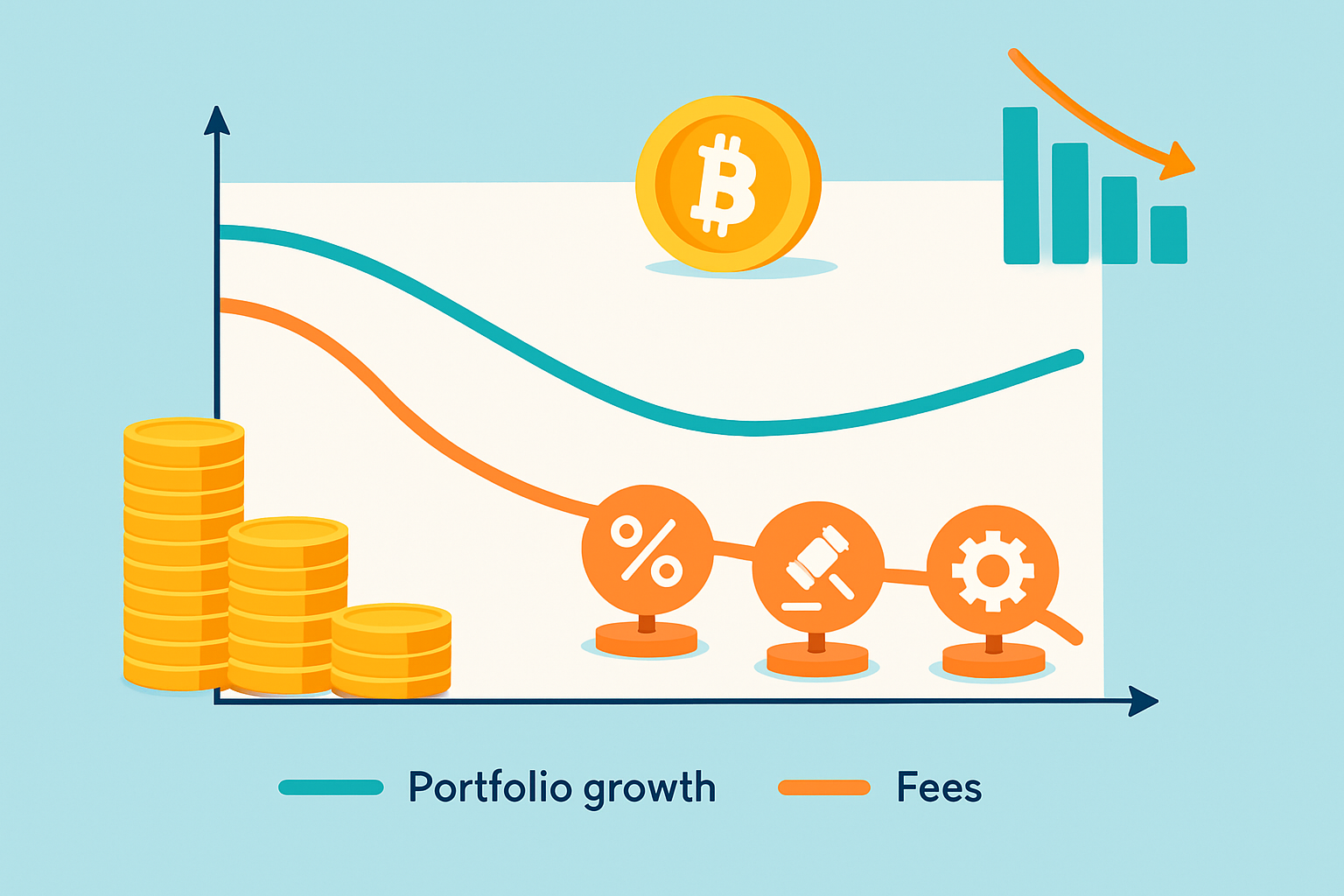

Crypto exchanges act as gateways where you buy, sell and trade digital assets. Trading fees can really make or break your overall profits.

Fees can chip away at your net gains, especially if you trade frequently or move large sums. Whether you’re a short-term trader, a long-term investor or dabble occasionally, having a clear handle on fee structures can make all the difference.

Our Approach to Choosing the Top Crypto Exchanges with a Behind-the-Scenes Look

We dug into a bunch of factors during our selection process. That meant checking out exchanges’ fee structures and how upfront they are about costs. We also sniffed out hidden fees, sized up liquidity levels, weighed security measures, eyeballed daily trading volumes, and got a feel for the overall user experience.

- Took a close look at maker and taker trading fees to get a real sense of cost efficiency across different order types because no one likes surprise charges sneaking up on them

- Compared withdrawal and deposit fees and dug deeper to sniff out any hidden costs that might catch you off guard

- Checked how clearly and transparently fees are laid out to help users dodge frustrating unexpected costs

- Reviewed reputation and trustworthiness by scouring community feedback and making sure regulatory boxes are ticked; trust me it’s a big deal in this space

- Investigated security features like two-factor authentication and cold storage because keeping your assets safe is no joke

- Considered the user interface’s friendliness and how smoothly even newbies can find their way around without breaking a sweat

- Listed the variety of supported cryptocurrencies and trading pairs to see how flexible the platform really is

- Made sure to confirm geographic availability and any restrictions that could throw a wrench in the plans of global users

1. Binance The Go-To Pick for Low Fees and a Pile of Handy Features

Binance really shines as a top dog in the crypto exchange world boasting one of the friendliest fee setups you will find. It keeps things simple with a flat 0.1% fee for both makers and takers. If you’re savvy enough to use Binance Coin (BNB), you might snag a discount that dips it down to about 0.075%. Withdrawal fees vary depending on the crypto you are dealing with but generally stay competitive. You won’t be left guessing since everything’s laid out clearly from the get-go. On top of that, Binance offers solid liquidity which helps keep slippage low. Plus, it supports a huge range of cryptocurrencies and offers some pretty slick advanced trading tools.

2. Kraken A Solid Pick for Security and Straightforward Fees

Kraken lays out its fee structure with crystal-clear transparency. Maker fees start at a modest 0.16% and taker fees at 0.26%, which generally holds its own in the competitive market. People tend to appreciate that there are no sneaky hidden charges and that every cost is spelled out from the start. But it’s not just about low fees here—Kraken doubles down on security with features like cold wallet storage, strict compliance with global regulations and robust safeguards for users.

3. KuCoin A Solid Pick for Low Trading Fees and an Impressive Assortment of Altcoins

KuCoin offers some of the lowest base trading fees you will find. They start at a mere 0.1% for both maker and taker orders. If you want to reduce costs further, paying with their native token KCS unlocks sweet discounts and extra rewards as a thank-you for sticking around. The platform offers many altcoins and tokens, which naturally draws traders who appreciate a diverse lineup without high fees.

4. Coinbase Pro A Solid Pick for Beginners Hunting Low Fees

Coinbase Pro comes with much lower fees than its retail counterpart, which really makes it a magnet for new users stepping into the world of active trading. The tiered fee structure kicks off at 0.5% but can drop all the way down to a mere 0.04% if you’re moving big volumes—talk about a nice incentive.

5. Bitstamp Definitely a Top Pick for European Users Thanks to Its Friendly Fees

Bitstamp lays out a pretty clear and competitive fee structure that usually works out nicely for European traders. Maker and taker fees kick off at 0.5%, then ease down to 0.25% as your trading volumes pick up pace.

Fee Comparison Table for Leading Crypto Exchanges A Quick Look at What You’re Really Paying

| Exchange | Maker Fee | Taker Fee | Withdrawal Fee | Deposit Fee | Special Discounts / Promotions |

|---|---|---|---|---|---|

| Binance | 0.1% (drops to 0.075% if you’re using BNB) | 0.1% (also 0.075% with BNB, because who doesn’t love a little saving) | Fees vary depending on the coin; for instance, 0.0005 BTC for Bitcoin | Free | Snag a neat 25% fee discount by paying with BNB tokens |

| Kraken | Starts at 0.16% but can go all the way down to 0.00% for those high-volume wizards | 0.26% going down to 0.10% if you trade a lot like a pro | Varies by cryptocurrency, like 0.00015 BTC for example | Free | Straightforward, no-nonsense fees with no hidden surprises |

| KuCoin | 0.1% | 0.1% | Fees shift around a bit but always stay competitive | Free | Score some discounts when you pay fees with the KCS token |

| Coinbase Pro | From a hefty 0.5% down to a slim 0.04% if you’re a high-volume trader | Same deal: 0.5% down to 0.04% | Network fees apply and can fluctuate by asset | Free | Tiered, volume-based fees that might just reward your trading hustle |

| Bitstamp | Ranges between 0.5% and 0.25% for those who trade a lot | Between 0.5% and 0.25%, depending on your volume | Around 0.0005 BTC for Bitcoin, give or take | Free | Lower fees kick in once you clear certain trading volumes |

Other Important Factors to Keep in Mind Besides Fees (Because There is More to the Story)

Fees are definitely important but choosing a crypto exchange is about more than that. You’ll want to keep an eye on security measures and how well it sticks to regulations. Also consider how user-friendly it is, the variety of assets on offer and of course the quality of customer support.

- Robust security features like cold storage and two-factor authentication work behind the scenes to keep your funds locked up tight far away from hackers and thieves

- Sticking to regulations lowers the odds of surprise shutdowns or legal headaches which is always a relief

- A intuitive interface takes the intimidation out of trading making it way easier to get started especially if you’re new to the game

- High liquidity means you can jump into and out of trades quickly without causing a ripple in the price which traders definitely appreciate

- Fast and friendly customer support is a lifesaver when you hit a snag cutting downtime and smoothing out account or technical glitches

- A wide variety of cryptocurrencies lets you mix and match to build a portfolio that really suits your style

- Dependable platform performance keeps things running smoothly so you’re not left hanging during those nail-biting market moments

How to Cut Down on Fees When Trading Crypto (Without Breaking the Bank)

When using the best crypto exchanges, keeping fees low can really add up and make a noticeable difference in your trading profits. I’ve found that using maker orders instead of taker orders is a smart move, and it never hurts to take advantage of native exchange tokens for some neat discounts. Timing your transactions to dodge network congestion can save you a fair bit, and picking deposit methods that tend to be cheaper helps too.

- Whenever possible try to use limit or maker orders since they usually have lower maker fees. These fees can add up if you don’t watch out

- If you can keep and pay fees using the exchange’s native tokens to get some nice discounted rates

- Avoid the temptation to make frequent small withdrawals because fees can sneak up on you and increase your costs

- When it comes to deposits bank transfers usually work better than credit cards which tend to have higher fees

- Make it a habit to regularly check fee schedules across different exchanges so you’re always informed and can switch if a better deal shows up

Frequently Asked Questions

How do maker and taker fees differ, and which should I focus on?

Maker fees kick in when you’re adding liquidity to the order book—think of placing limit orders—while taker fees happen when you take liquidity away like with market orders. Generally maker fees are friendlier on the wallet so it’s often smart to lean on limit orders if you want to keep costs down, especially if you trade regularly. Exchanges like Binance and KuCoin tend to roll out generous discounts for maker orders making it worth your while.

Are there hidden fees I should watch out for beyond trading costs?

Yep, some exchanges aren’t shy about tacking on extra charges for deposits or withdrawals or just sitting idle. It definitely pays to dig into the fine print for things like network fees, currency conversion costs or penalties for dipping below minimum balances. On the plus side Kraken and Bitstamp get points for transparency since they lay out all potential fees upfront with no surprises.

Can I really lower fees by holding an exchange’s native token?

Absolutely. Exchanges such as Binance (with BNB) and KuCoin (with KCS) offer pretty sweet fee discounts—sometimes up to 25%—when you pay fees using their native tokens. This approach works best if you’re an active trader but it’s worth checking if the token’s volatility sits well with your risk appetite before diving in.

Is Coinbase Pro’s fee structure better than regular Coinbase?

Yes indeed. Coinbase Pro uses tiered fees that can drop as low as 0.04% for large trades which is a far cry from Coinbase’s flat spreads that often top 1.5%. Beginners can save a bundle by switching to Pro though the interface isn’t quite as beginner-friendly and might take a minute to get used to.

How important is liquidity when choosing a low-fee exchange?

It’s absolutely key. High liquidity—as you’ll find on giants like Binance—means you can execute trades quickly without worrying about price slippage cutting into your savings. Low fees are great but if there’s not enough market depth those savings might disappear before you know it. Checking 24-hour trading volumes can give you a good feel for an exchange’s liquidity and help you make an informed choice.

What’s the best way to compare fees across exchanges?

Start by eyeballing the exchange’s official fee schedule—usually tucked under 'Fees' or 'Pricing'—and lean on handy tools like CoinMarketCap’s exchange comparison. Focus on what matters most to you whether that’s trading frequency, order types or how you prefer to move your money in and out. And hey, our article’s comparison table is a solid spot to kick off your research.

Start Your Crypto Journey with Coinbase Today

Ready to enter the cryptocurrency market but unsure where to begin? Coinbase makes buying, selling, and storing digital assets simple and secure for beginners and experts alike.