6 articles

Access decentralized lending and borrowing protocols that enable users to earn passive income by supplying crypto assets as collateral or obtaining loans without traditional credit checks. These DeFi platforms provide automated interest rate optimization, instant liquidity access, and the ability to leverage crypto holdings while maintaining ownership, delivering higher yields than traditional banking and democratizing access to financial services globally.

Discover how fractional reserve lending allows banks to boost economic growth by lending more than they hold and why it’s vital for investors to understand this banking cornerstone.

Explore how leading DeFi lending platforms stack up on rates, security, and features to help you confidently choose the right decentralized finance solution.

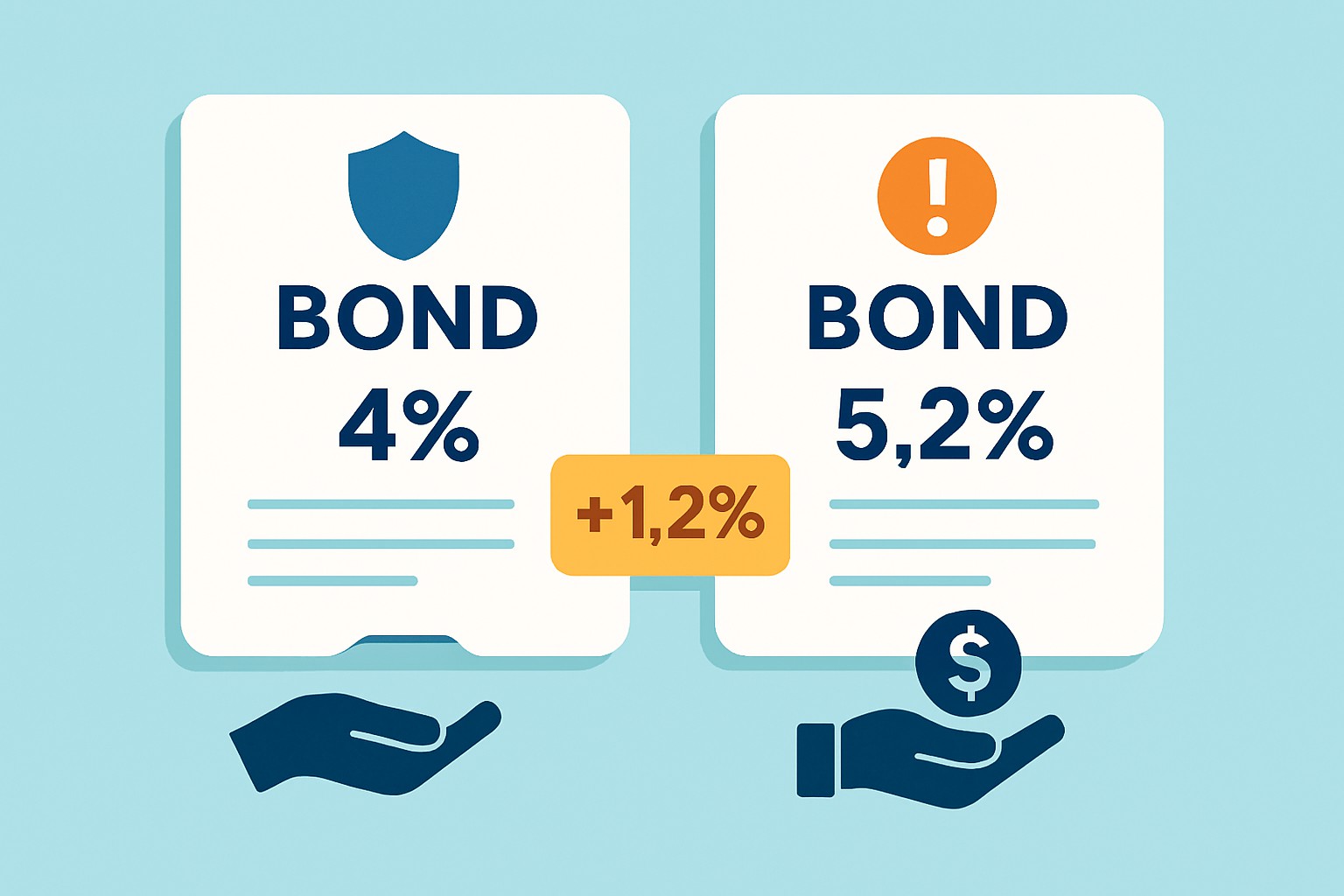

Credit spreads measure the extra interest investors demand to lend to riskier borrowers. This article breaks down what credit spreads are, how they work, and why they matter—all explained simply.

Explore Maple Finance, a DeFi platform bridging institutional borrowing and decentralized lending with innovative credit management and transparent pools.

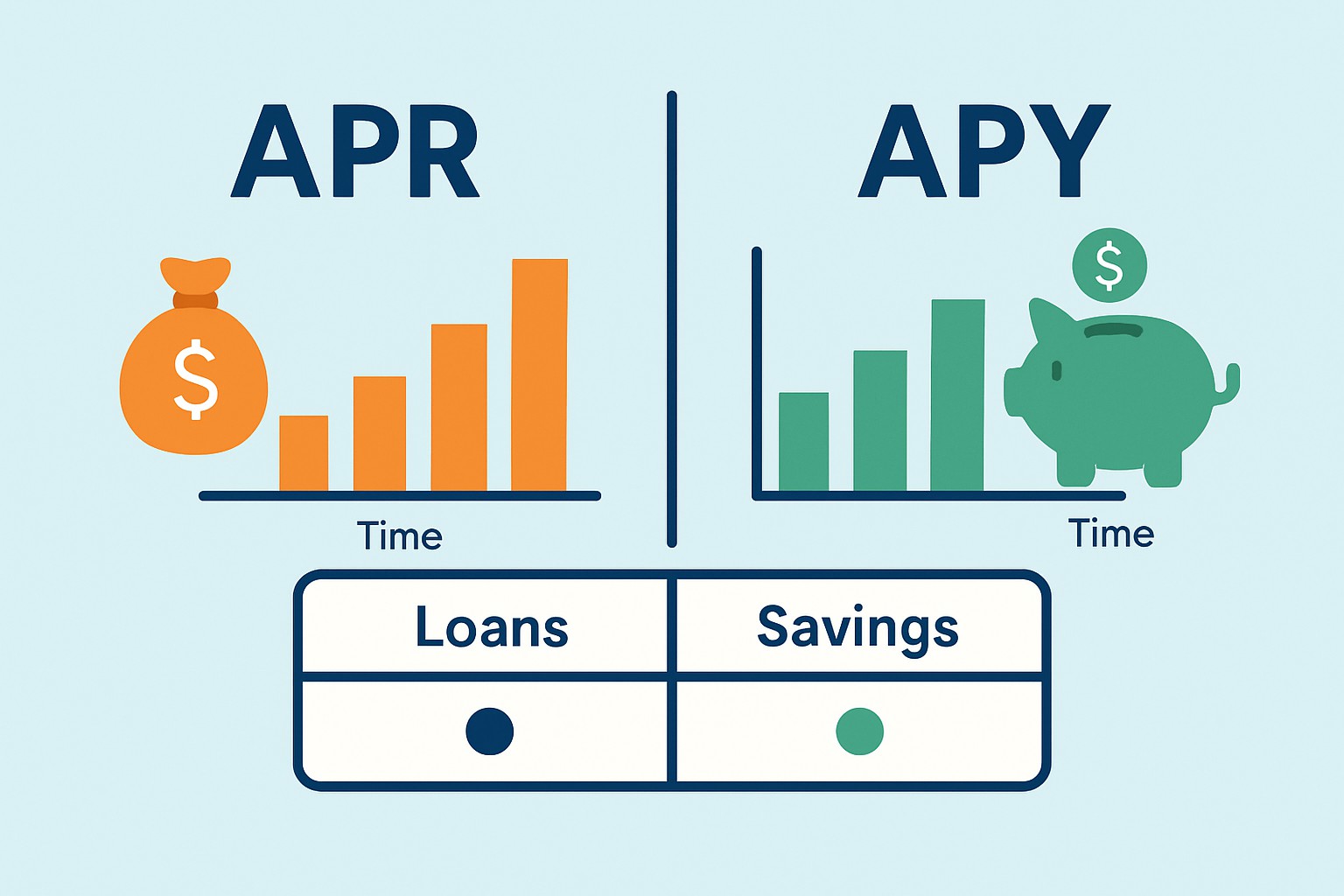

Confused about APR and APY? This article breaks down the key differences, showing how they impact your loan costs and investment returns with easy-to-understand explanations.

Discover what Aave is and how it empowers users to lend and borrow crypto in decentralized finance. This beginner-friendly guide breaks down how Aave works and how to get started.