BTC Dominance Trends and What They Mean

Bitcoin dominance often called BTC dominance shows the slice of the entire cryptocurrency market cap that Bitcoin holds onto. Think of it as a kind of barometer for investors, giving a clearer picture of how much clout Bitcoin still commands amid the ever-growing crowd of altcoins.

This article breaks down BTC dominance in plain and easy-to-grasp terms—no tech jargon needed. It explains how this metric is measured and why traders and investors care about it. It also explores what the latest trends might reveal about the crypto market’s next moves.

What Does BTC Dominance Really Mean?

BTC dominance reflects the slice of the pie that Bitcoin’s market capitalization takes up compared to the entire cryptocurrency market combined. It shows just how much muscle Bitcoin is flexing among the vast sea of altcoins out there.

- Bitcoin market cap is essentially the total value of all Bitcoins currently floating around, which you get by multiplying the current price by the number of coins available.

- Total crypto market cap takes things a step further by adding up the market caps of Bitcoin and every other cryptocurrency, including colorful altcoins.

- The BTC dominance ratio is figured out by dividing Bitcoin’s market cap by the total crypto market cap and then multiplying by 100 to get a neat percentage.

- This isn’t the same as Bitcoin’s price because it shows Bitcoin’s standing compared to the entire crypto market, not just how much one coin costs.

- BTC dominance acts like a handy barometer for market mood. It shows the tug-of-war in popularity between Bitcoin and altcoins and hints at how confident investors feel at any moment.

When you line up Bitcoin's market cap against the entire crypto ecosystem's value, BTC dominance basically tells the tale of Bitcoin's slice of the pie.

Why Does BTC Dominance Matter So Much?

BTC dominance matters because it gives us a glimpse into how investors are feeling about Bitcoin compared to altcoins. When BTC dominance climbs, it usually signals that Bitcoin is flexing its muscles or that investors are leaning toward a safer bet amid choppy market waters and uncertainty.

- It serves as a market sentiment barometer, giving a sense of whether investors are sticking with Bitcoin’s steady vibe or starting to chase the thrillier rides of altcoins.

- BTC dominance often gives a heads-up on when those altcoin seasons tend to kick off, pointing to windows where altcoins might just steal the spotlight from Bitcoin.

- This metric gauges the market’s overall appetite for risk, with dips usually hinting that traders are getting a bit more adventurous and speculative.

- Investors lean on it to help fine-tune how they divvy up their portfolios between trusty Bitcoin and the ever-evolving world of altcoins.

- BTC dominance also sheds light on the crypto market’s growing maturity, showing how investor interests are starting to spread their wings and diversify.

BTC dominance often plays the role of a market thermometer, giving us a pretty good sense of how confident investors are feeling about Bitcoin versus the rest of the crypto gang. When that dominance ticks upward, it usually signals a return to Bitcoin’s well-earned reputation as the safer bet, the old reliable in an otherwise wild ride.

So, How Exactly Do We Calculate BTC Dominance?

Calculating BTC dominance boils down to two main pieces: Bitcoin's market capitalization and the total market capitalization of all cryptocurrencies combined. Market cap is found by multiplying a coin's current price by how many are in circulation. To figure out BTC dominance as a percentage, take Bitcoin's market cap, divide it by the entire crypto market cap and then multiply by 100.

| Cryptocurrency | Market Cap (USD) |

|---|---|

| Bitcoin (BTC) | $800 billion |

| Ethereum (ETH) | $350 billion |

| Binance Coin | $50 billion |

| Cardano | $40 billion |

| Others | $260 billion |

| Total Market Cap | $1.5 trillion |

BTC Dominance = (800B / 1.5T) × 100 = 53.3%, which really shows Bitcoin isn’t going anywhere anytime soon.

The dominance figure tends to shift whenever new cryptocurrencies pop onto the scene including the thousands of altcoins and tokens crowding the market. Stablecoins are cryptocurrencies pegged to fiat currencies and often swell the total market cap without boosting Bitcoin's market cap. This usually nudges BTC dominance downward. Meanwhile, forks or token burns change circulating supplies and ripple through these calculations.

A Closer Look Back at BTC Dominance Trends

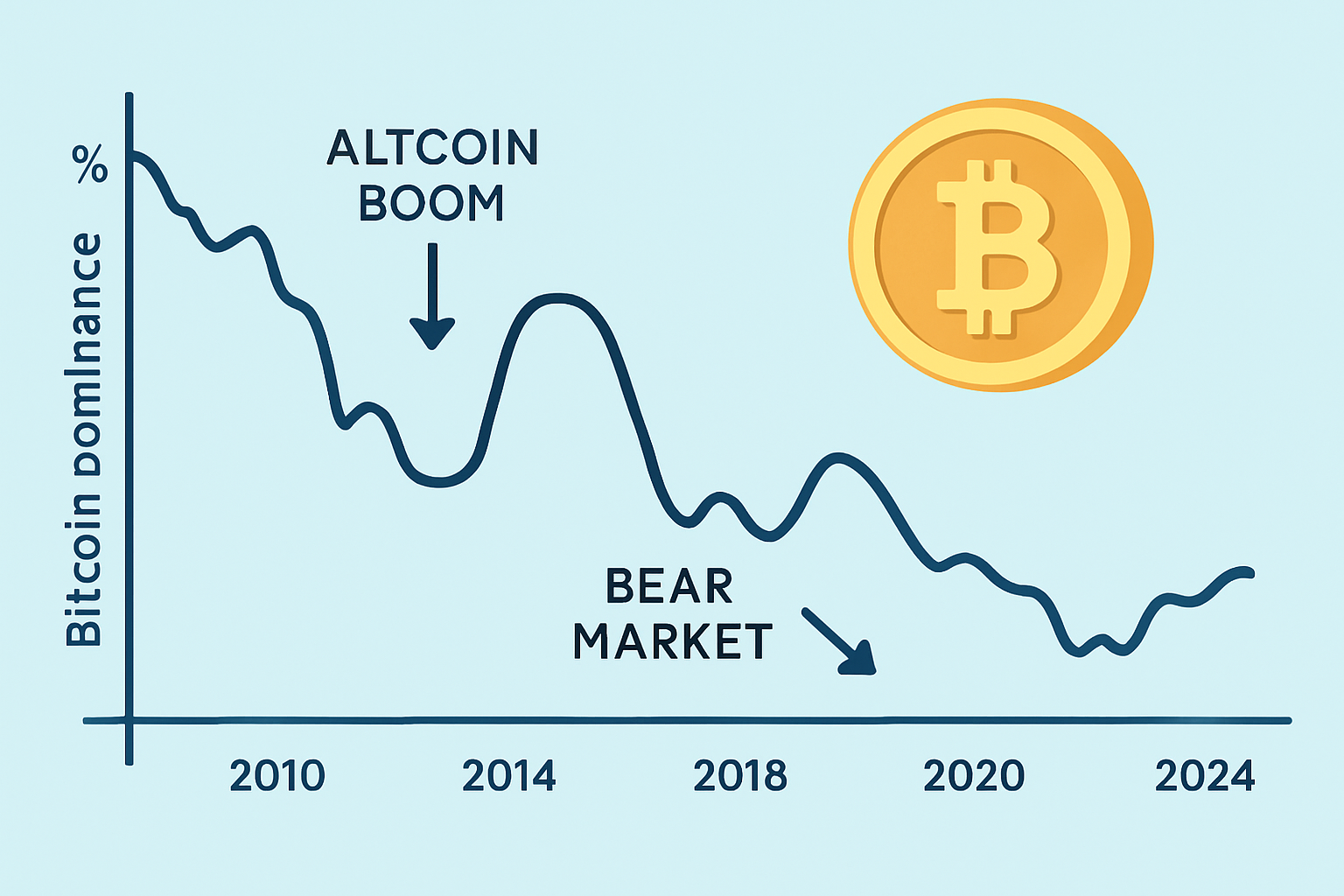

BTC dominance has seen quite the rollercoaster ride since Bitcoin first made its grand entrance. It started close to 100 percent but slowly eased down as altcoins gained traction during altcoin seasons. Over the long haul, dominance ebbs and flows with market cycles. It usually climbs during bear markets when investors seek Bitcoin's safety blanket and dips during bull runs when riskier altcoins steal the spotlight.

- Back in Bitcoin's early days it pretty much ruled the roost since there were hardly any other cryptocurrencies to challenge it.

- Then starting around 2013 to 2014 altcoins like Ethereum started to nibble away at Bitcoin’s massive share slowly but surely.

- Whenever altcoins had their shining moments Bitcoin’s dominance would often take a nosedive as investors chased the next shiny new token.

- During bear markets Bitcoin dominance would bounce back as traders flocked to it like a safe harbor in stormy seas.

- Nowadays the scene feels a lot more balanced with Bitcoin’s dominance ebbing and flowing in step with the booming worlds of DeFi and NFTs.

This historical snapshot reveals that BTC dominance isn’t fixed. It rises and falls with technological breakthroughs and shifts in investor sentiment and the constantly changing market landscape.

What Are the Key Factors Behind Shifts in BTC Dominance?

BTC dominance tends to shift due to a handful of interconnected factors like market cycles and shifts in investor sentiment. Bursts of excitement or fresh innovation around new altcoins and updates in regulatory policies also influence it. Broader macroeconomic events usually stir the pot when it comes to how capital flows in the crypto world.

Bitcoin price moves tend to nudge BTC dominance up or down depending on how it stacks up against altcoins.

New altcoins stir up some buzz and fresh innovation, usually stealing a bit of the spotlight from Bitcoin. This pulls investor interest away and causes its dominance to dip as capital shifts.

The rise of stablecoins pumps up the overall market cap but doesn’t add to Bitcoin’s value, so you’ll often see dominance take a little tumble.

Regulatory updates can really swing investor confidence. Some people favor Bitcoin while others lean more towards altcoins depending on the latest headlines.

Trends in institutional adoption play their part too. Big players either double down on Bitcoin or spread their bets across altcoins, and that rhythm drives BTC dominance one way or the other.

Understanding these drivers gives investors a leg up in predicting why BTC dominance often climbs during nerve-wracking market stretches or dips when altcoin ecosystems suddenly take off like a rocket.

How Investors Often Lean on BTC Dominance When Making Decisions

Investors and traders often keep a close watch on BTC dominance trends to get a leg up when managing their portfolios, deciding the right moments to either double down on Bitcoin or explore the wild world of altcoins.

- When BTC dominance climbs investors often shift more of their funds into Bitcoin chasing a bit of safety and liquidity amid the chaos.

- Keeping an eye on drops or rebounds in dominance can spot when altcoin seasons kick off or wind down. This is useful for catching potential upsides.

- Traders frequently lean on BTC dominance as a tool to hedge their bets and balance their portfolios especially when the market starts throwing curveballs.

- Pairing BTC dominance with other technical indicators sharpens the edge on timing market entries and exits making decisions less of a shot in the dark.

- Taking BTC dominance alongside volume and sentiment data paints a clearer and more complete picture of the market. This helps steer decisions with more confidence.

A cautious investor spotting Bitcoin dominance climbing during nerve-wracking market ups and downs might pull back from smaller altcoins and lean heavier into Bitcoin to keep their capital safe and sound. On the flip side, a more daring trader seeing dominance take a dip could throw more chips onto growth-focused altcoins chasing bigger gains.

Common Mistakes People Often Make About BTC Dominance

There are quite a few misconceptions floating around about BTC dominance that can easily trip up investors. Individuals often confuse it with just Bitcoin's price strength or lean on it as if it’s some foolproof crystal ball for market direction.

- BTC dominance doesn’t always mean Bitcoin’s price is rising. It simply shows how much of the market pie Bitcoin currently holds.

- When BTC dominance goes up, it doesn’t always signal trouble for altcoins or mean they are losing value.

- A growing stablecoin supply can lower BTC dominance without saying much about Bitcoin’s actual market performance.

- By itself, BTC dominance isn’t the best indicator for predicting Bitcoin’s price changes or market cycles.

- Investors should be careful not to rely solely on BTC dominance when making complex investment decisions.

Clearing up these points helps investors dodge common traps from placing too much faith in BTC dominance alone. Taking a well-rounded approach that balances price patterns with volume trends and market sentiment alongside broader economic factors tends to lead to smarter and more confident moves in crypto investing and trading.

Peering Into the Future of BTC Dominance in an Ever-Shifting Crypto Landscape

Several factors like increasing institutional adoption and steady progress in decentralized finance (DeFi) seem poised to shake up BTC dominance. The rapidly expanding world of non-fungible tokens (NFTs) and shifting regulatory landscapes also contribute.

Investors should be ready for BTC dominance to keep acting like a moving target, reflecting not just price swings but also the ever-shifting landscape of the crypto market.

Frequently Asked Questions

Does a high BTC dominance mean Bitcoin's price is going up?

Not necessarily. BTC dominance measures Bitcoin's slice of the total crypto pie. It can tick up even if Bitcoin's price dips as long as altcoins lose ground faster. So it really tells you how Bitcoin stacks up against other coins, not just the direction of its price.

How can stablecoins affect the BTC dominance calculation?

Stablecoins boost the total crypto market cap since they’re counted in the mix. Because their value is pegged to fiat and they don’t directly compete with Bitcoin, a big stablecoin supply can push BTC dominance lower even when Bitcoin’s market performance stays steady. It’s a subtle effect but worth keeping in mind.

Should I sell my altcoins when BTC dominance is rising?

A rising BTC dominance often signals investors are shifting from riskier altcoins into Bitcoin to seek more safety. It’s not a magic bullet but can be a handy hint to consider tweaking your portfolio and leaning towards steadier assets during shaky market spells.

What is considered a 'normal' level for BTC dominance?

There’s no one-size-fits-all 'normal' here. BTC dominance has ranged from nearly 100% in the early days to lows around 35-40% during hot altcoin seasons. The best approach is to watch how it trends alongside the market cycle.

Can I use BTC dominance alone to time my investments?

Nope, putting all your eggs in that basket isn’t the smartest move. BTC dominance gives a useful snapshot of market sentiment and Bitcoin’s strength relative to altcoins but works best when combined with other clues like price action, trading volume and the bigger economic picture to help you make smarter calls.

Useful Links

Start Your Crypto Journey with Coinbase Today

Ready to enter the cryptocurrency market but unsure where to begin? Coinbase makes buying, selling, and storing digital assets simple and secure for beginners and experts alike.