Liquid Staking Explained for Crypto Investors

Liquid staking is quietly shaking up the way crypto investors rake in rewards while keeping their hands on their funds. Usually staking cryptocurrencies means your assets get locked for a set period. This can feel like tying up your money in a safe with no key. Liquid staking flips the script by allowing investors to stake assets and receive tradable tokens that stand in for their stake. This trick offers more flexibility and opens the door to exciting DeFi opportunities. We’ll walk you through liquid staking step-by-step, diving into how it works, the perks and pitfalls, and which platforms are in the game.

What Does Liquid Staking Actually Mean?

Liquid staking lets you stake your tokens without the headache of locking them away and losing access. Instead, you receive a fresh new token that stands in for your staked assets. Unlike the old-school staking method that handcuffs your funds, liquid staking keeps things flexible and usable so you can still put your assets to work while reaping those sweet rewards.

- Staking is basically like putting your crypto in a time-locked vault to help keep the blockchain ticking and earn some rewards along the way.

- With traditional staking, your assets are tied up tight—you can’t sell or use them until the lock-up period ends.

- Enter liquid staking which flips the script by turning your staked assets into tokens you can trade on the fly.

- These liquid tokens give you the freedom to trade, transfer or use them as collateral on other DeFi platforms, keeping your options wide open.

- Liquid staking protocols usually cut down or sometimes completely wipe out the usual wait time to get your funds, all while you’re still racking up rewards.

- This means investors keep earning those sweet rewards without sacrificing liquidity and making their capital hustle harder and work smarter.

Liquid staking is a bit like parking your money in a fixed deposit at the bank where it quietly earns interest. But here’s the twist: instead of just waiting around for the term to end, you receive a certificate that you can actually sell or use as collateral whenever the mood strikes. This certificate isn’t just a piece of paper—it mirrors the value of your deposit plus the interest piling up, giving you the comfort of a locked deposit while still letting you tap into your funds whenever necessary.

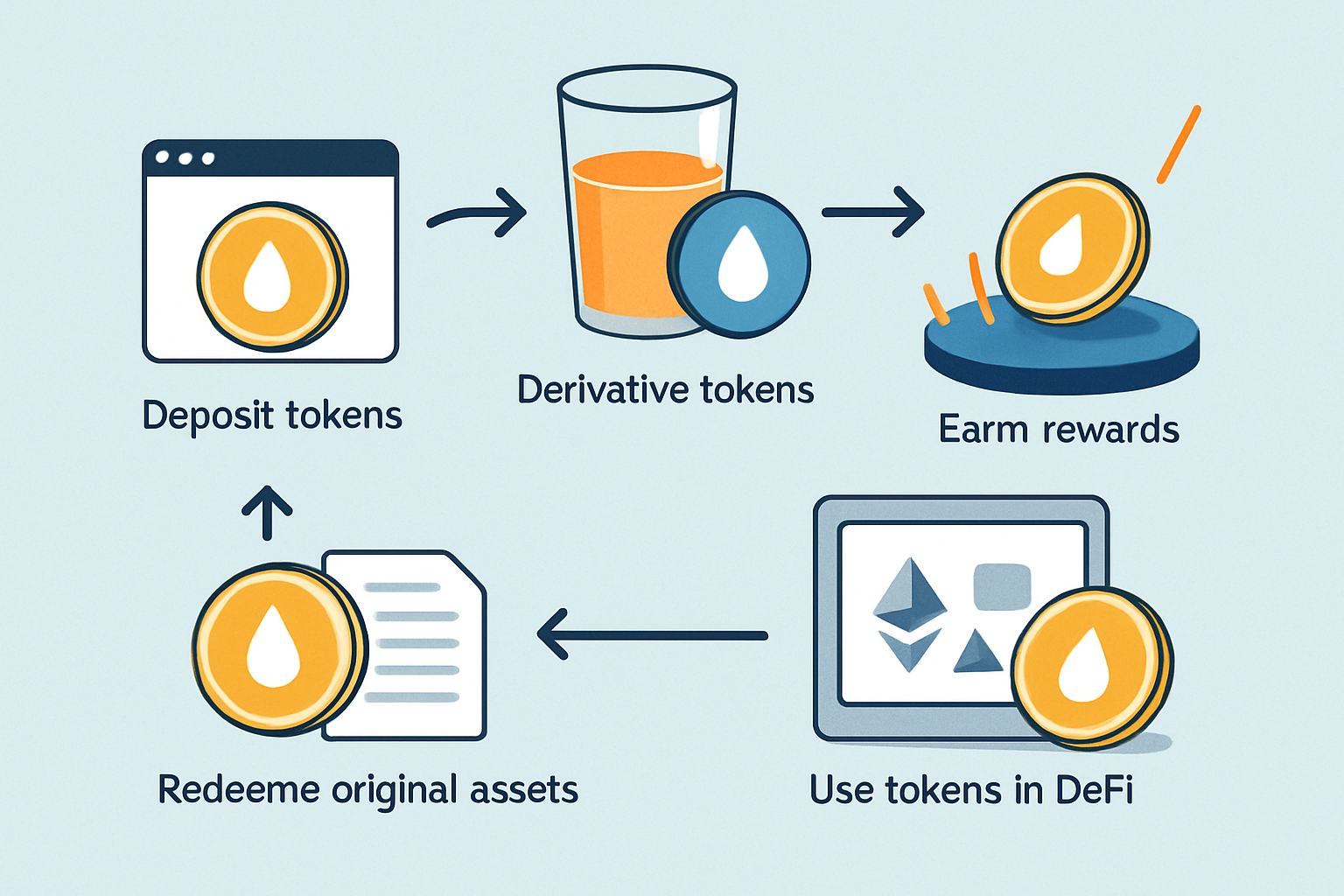

What Actually Goes Down When You Stake Your Liquid Assets?

Liquid staking lets investors snag those sweet staking rewards without having to lock up their funds thanks to tokenized derivatives. Here’s the deal in plain English: you deposit your tokens and receive liquid tokens in return. You can trade them freely and rack up rewards along the way.

The user tosses their tokens into a liquid staking protocol designed to play nice with their cryptocurrency.

The protocol takes those tokens and stakes them on the blockchain. It works behind the scenes to rack up staking rewards.

In return the user is handed liquid staking derivative tokens that act as a stand-in for their staked assets.

Those liquid tokens aren’t just sitting pretty—they can be used in DeFi for lending, as collateral, or simply traded.

When the user feels it’s time to cash out they redeem those derivative tokens to pull back their original assets along with any rewards they have earned.

Popular Platforms Where Liquid Staking Shines

| Platform Name | Supported Blockchains | Token Type Issued | Average APY | Key Features |

|---|---|---|---|---|

| Lido | Ethereum, Solana, Polygon | stETH, stSOL | 4-7% | Boasts a hefty liquidity pool, strong DeFi ties, and a reputation that inspires trust |

| Rocket Pool | Ethereum | rETH | 3.5-6.5% | Truly decentralized and community-driven, rewarding those who run nodes with perks |

| Ankr | Multiple (ETH, BNB, Polkadot) | aTokens | 4-8% | Supports a bunch of blockchains, sports a intuitive interface, and offers solid liquidity |

| Marinade | Solana | mSOL | 5-7% | Known for low fees, speedy withdrawals, and seamless integration deep in Solana’s world |

| StakeWise | Ethereum | sTokens | 4-6% | Delivers auto-compounding rewards alongside flexible staking options — it’s pretty convenient |

| Lidoverse | Ethereum, Near, others | LSD Tokens | 3-8% | Expanding its cross-chain liquid staking offerings, growing steadily but surely |

These platforms highlight the vast spectrum and growing innovation in liquid staking services. Each one has its own flavor with different degrees of decentralization and a variety of supported blockchains. User experiences can range from smooth sailing to a bit of a learning curve.

Why Crypto Investors More Often Than Not Lean Toward Liquid Staking

- You don’t lose liquidity since your staked funds stay accessible through these nifty derivative tokens.

- Having the freedom to trade or put your liquid staking tokens to work in other DeFi protocols often gives your capital a nice little efficiency boost.

- By putting those derivative tokens to good use again and again, you can rack up compound yields that really help pad your overall returns.

- It cuts down on the opportunity costs tied to locked tokens by letting you tweak your portfolio whenever the mood strikes.

- It slots in smoothly with the broader DeFi ecosystem, opening the door to all sorts of yield and lending opportunities.

- Liquid staking helps spread out risk by diversifying your staking exposure across a range of validators or protocols, which is always a smart move in my book.

Liquid staking lets you rake in rewards from staking while still keeping your assets nimble and ready to move in the ever-shifting crypto market.

Risks and Things to Keep in Mind When It Comes to Liquid Staking

Liquid staking definitely has its perks but it’s not without risks you should keep on your radar. For one, vulnerabilities in smart contracts could put your assets in a tight spot. Plus, those derivative tokens might not always match the value of your staked assets. There’s also the chance of validator slashing, protocol insolvency, and liquidity problems. This means you might find yourself unable to cash out derivative tokens immediately or getting less than their full value when you do.

- Bugs lurking in smart contracts can lead to the loss or theft of staked funds—something nobody wants to wake up to.

- Liquidity risks kick in when there aren’t enough eager buyers for staking derivatives and leave sellers in a bind.

- Tokens that represent staking derivatives often trade for less than the value of the underlying assets, which can sting.

- Validator slashing penalties might not only shrink your rewards but also nibble away at your principal—a tough pill to swallow.

- Your assets hang in the balance if the platform becomes insolvent or isn’t managed properly—crucial to keep in mind.

- New regulations could shake things up and potentially change the rules for liquid staking and how it’s legally viewed.

Getting Started with Liquid Staking A Friendly Guide

Starting out with liquid staking isn’t too complicated, especially if you stick to a straightforward process. First things first, set up a crypto wallet compatible with the blockchain you’re interested in and grab some tokens for it. Next, pick a reliable liquid staking platform—you want to avoid any shady corners. Once you deposit your tokens, you’ll get derivative tokens back. These little guys let you trade or use your holdings while still racking up those staking rewards.

Start checking out liquid staking protocols that support your blockchain and offer rock-solid security because safety comes first.

Set up a wallet that works well with your chosen platform like MetaMask or Phantom. It’s a simple step that will save you headaches later.

Grab your tokens and deposit them into the liquid staking protocol through their interface. Think of it as handing over your tickets for the ride.

You’ll receive liquid staking derivative tokens that represent your stake as if your original tokens sent a proxy to the party.

You can now use, trade or lend these tokens across various DeFi platforms or just hold tight and watch your rewards roll in.

Keep an eye on your staking rewards and any platform updates. When the time feels right, redeem your tokens and cash out. Easy does it.

Liquid Staking Compared to Traditional Staking

| Factor | Traditional Staking | Liquid Staking |

|---|---|---|

| Liquidity | Tokens get locked up and out of reach | Tokens stay tradable and ready for action |

| Rewards | You rack up staking rewards | You earn rewards plus the chance for some sweet compound gains |

| Lock-up Period | Fixed or variable periods you have to stick around for | Little to no lock-up periods, so you’re not tied down |

| Risk Profile | Risk of validator slashing, though generally lower platform risk | Adds some extra smart contract and platform risks – a bit like juggling flaming torches |

| Usage in DeFi | Mostly sits on the sidelines during lock-up | Derivative tokens get to play in the DeFi sandbox |

| Tokenization | No fancy tokenization of your staked assets | Your stake gets a tokenized avatar to roam around |

These differences really do matter when it comes down to the nitty-gritty. Traditional staking usually clicks with investors who value security and are happy to hold onto their assets for the long haul. Meanwhile, liquid staking tends to draw in people who crave more flexibility and want to manage their portfolios actively.

Looking Ahead at Liquid Staking in DeFi What’s Next on the Horizon

Liquid staking is poised to become a cornerstone of the DeFi ecosystem as blockchain networks keep expanding and the appetite for staking shows no signs of slowing. Innovations like cross-chain liquid staking and slicker staking derivatives will boost liquidity. Seamless integration with automated yield strategies should improve investor returns. Meanwhile, new Layer 2 solutions and shards offer faster and cheaper transactions, making liquid staking more accessible for everyone.

There are still a few hurdles to jump over like tightening up smart contract security and ironing out clearer regulations. Beefing up liquidity pools is also important. The steady strides in protocol audits and the clearer regulatory landscape hint at a promising future for liquid staking. Growing teamwork between different protocols also supports this outlook.