What Does Liquidity Mean for Markets?

Liquidity is one of those behind-the-scenes heroes that keeps all markets humming along, whether we are talking old-school traditional setups or the shiny new world of decentralized finance. Put simply, liquidity is about how easily you can buy or sell an asset without sending its price on a rollercoaster ride. When it comes to DeFi, liquidity takes center stage because it really shapes how effortlessly trades get done and how welcoming the market feels to everyone—from the small-time player to the big fish. For individuals just dipping their toes in, liquidity might seem like a slippery concept wrapped in jargon.

What Does Liquidity Mean? A Simple Take That Everyone Can Grasp

Liquidity is basically about how quickly and smoothly you can flip an asset into cash or another asset without shaking up its price too much. Think of liquidity as the market’s version of smooth sailing. Assets that are super liquid let you buy or sell big chunks fast without taking a hit on their value. Take cash, for instance. It is the king of liquidity because you can spend it on the spot with no fuss.

- Liquidity is how fast you can sell an asset without losing value. It’s like getting out of a crowded room without stepping on anyone’s toes.

- Market depth shows the amount people are ready to buy or sell at different price levels. It’s like the layers of an onion; when you peel one back, there’s another beneath.

- Price stability means your trades won’t send the asset's value on a wild rollercoaster ride. Smooth sailing, in other words.

- Speed of transactions tells you how quickly trades usually get wrapped up. Sometimes patience isn’t a virtue in the trading world.

- Asset convertibility measures how easily you can swap that asset for cash or something else. Think of it as how quickly you can turn your goods into cold hard cash when you need it.

Why Liquidity Is So Key in Markets (and Why It Matters More Than You Think)

Liquidity is absolutely key for keeping markets running smoothly and fairly for everyone. When liquidity is humming along nicely, traders can jump in or out of positions without breaking a sweat. Prices usually mirror the true market value and more individuals are eager to join the party. On the flip side, when liquidity dries up, things can get pretty wild with higher volatility, annoying slippage, and sneaky market manipulation.

It lets trades happen in the blink of an eye so investors don’t have to twiddle their thumbs waiting or settle for prices that feel like a bad deal.

High liquidity tends to keep shady characters at bay by making it costly to mess with prices and helps keep the market on the up and up.

It usually smooths out wild price swings and creates a calmer, more stable trading scene.

When liquidity is up investors generally feel more at ease and are quicker to jump into the action.

Liquidity is like the lifeblood of the market—it makes trading assets a breeze and helps make sure prices are fair. In my experience, this fuels healthy growth overall.

Understanding Liquidity in Traditional Financial Markets and Its Importance

In traditional markets like stocks, bonds and foreign exchange (forex), liquidity usually depends on a few trusty systems such as order books and market makers. Order books lay out buy and sell orders at different price points to offer a clear snapshot of market depth. Market makers play their part by constantly stepping up to buy and sell assets and make their profit from the gap between buying and selling prices called the bid-ask spread.

| Asset Type | Typical Liquidity Level | Market Participants Involved | Common Liquidity Measures |

|---|---|---|---|

| Stocks | Usually pretty liquid when it comes to well-known names, though things can get a bit trickier with small-cap stocks | Retail investors, institutional investors, market makers | Bid-ask spread, trading volume, order book depth |

| Bonds | Liquidity can swing from moderate to pretty high, depending largely on who’s issuing the bond and what type it is | Institutional investors, dealers | Bid-ask spread, number of trades per day, trading volume |

| Forex | Typically off the charts in liquidity, thanks to its global reach and huge trading volumes | Banks, currency traders, brokers | Spreads, trading volume, order book depth |

Taking a Closer Look at Liquidity in Decentralized Finance (DeFi)

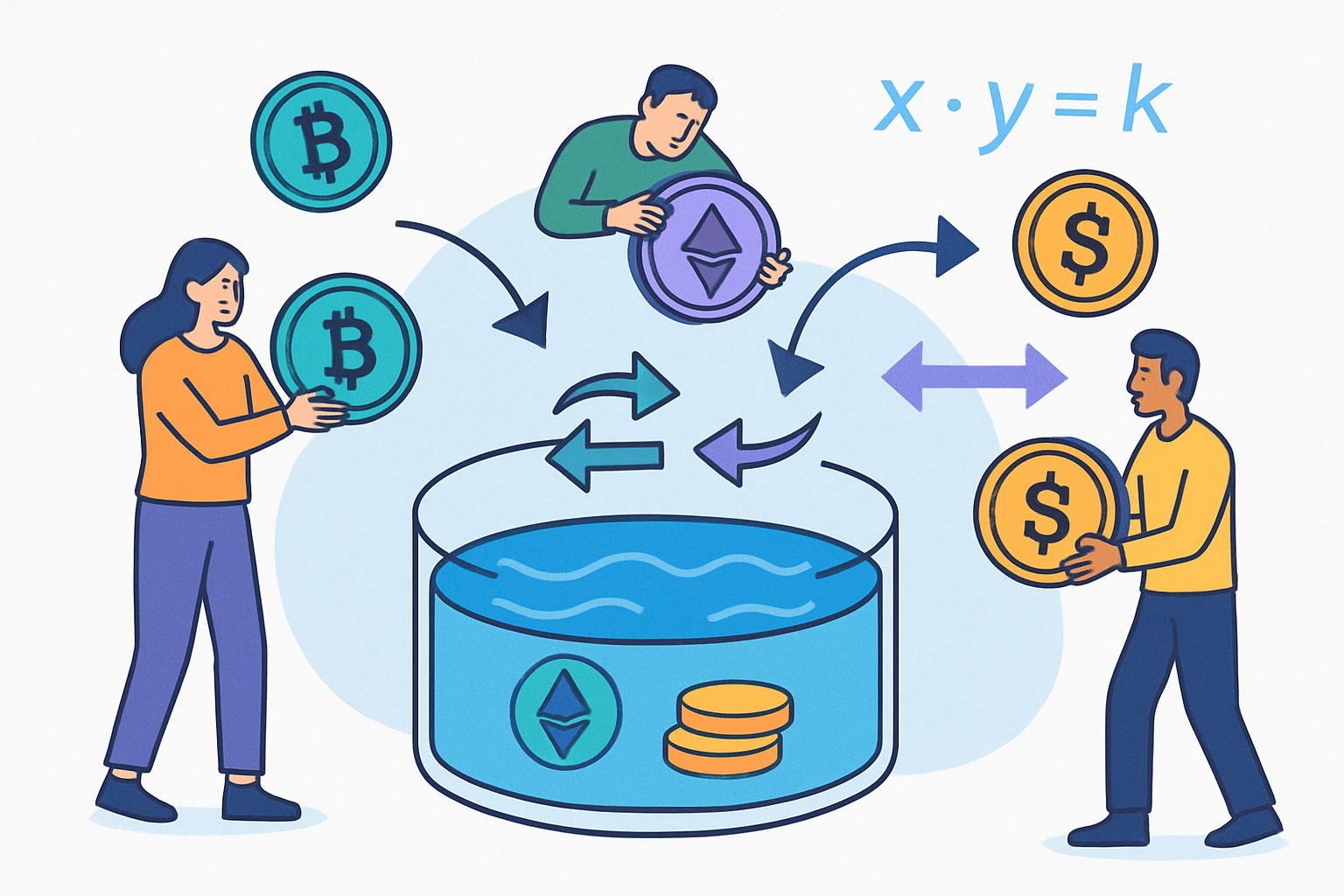

In the ever-shifting landscape of DeFi, liquidity plays by its own unique set of rules. Instead of relying on the usual centralized middlemen, DeFi throws its weight behind decentralized exchanges (DEXs) and automated market makers (AMMs) to get trades done. Liquidity typically flows from pools where users toss in pairs of tokens, keeping those token swaps running smoothly and efficiently. This peer-powered setup opens the door for just about anyone to pitch in with liquidity, though it also introduces quirky concepts like impermanent loss and little incentives for those who roll up their sleeves and provide liquidity to keep the system humming.

- Liquidity pools are smart contracts that keep pairs of tokens locked in and allow users to trade directly against them without fuss.

- Automated market makers or AMMs take a different route from traditional order books by using mathematical formulas to set asset prices. It is like math doing the heavy lifting behind the scenes.

- Token swaps happen right inside these pools, making exchanges quick and seamless with no middlemen holding things up.

- Impermanent loss is the risk liquidity providers face when token prices swing. It can feel like riding a rollercoaster with your investments.

- Liquidity providers earn fees as a thank-you for putting up liquidity, which can add up nicely if you’re playing the long game.

Why Liquidity Pools Really Steal the Spotlight in DeFi Markets

Liquidity pools lie at the core of decentralized trading and pull together assets from users to make swapping possible without relying on the old-school order book. This setup tackles liquidity issues early decentralized exchanges faced when low user activity made markets feel like ghost towns and caused illiquid trades and bad prices. These pools reduce slippage, speed up transactions, and keep asset pairs almost always available. By spreading risk and letting liquidity providers earn fees, they encourage everyone to jump in.

"Liquidity pools are kind of like a potluck where everyone throws in some assets, making trades run smoothly and quickly while sharing both the risks and the rewards. It is often a well-oiled marketplace that really depends on the community to keep the wheels turning, and honestly, that team effort is what makes it tick."

Why Liquidity Matters to Traders and Investors

Liquidity plays a key role for traders and investors by influencing the prices they snag and the strategies they lean on. When liquidity is high, even sizable trades tend to nudge prices only a little. Slippage stays minimal and pricing feels noticeably steadier. On the flip side, low liquidity often means wild price swings and higher costs. It can be a real headache when trying to jump in or out of positions quickly.

- Traders usually experience less slippage and enjoy smoother trade execution when markets have high liquidity.

- Price discovery becomes sharper and often leads to fairer and more transparent valuations that make everyone’s life easier.

- High liquidity typically tames volatility and sets the stage for steadier strategic investments.

- Jumping in and out of the market feels less like a chore and gives investors more wiggle room to handle their portfolios.

- Liquidity providers often snag fee incentives that keep them coming back to support the market’s lifeblood.

Clearing Up the Confusion

Liquidity plays a important role yet is often misunderstood or overlooked. Lots of individuals mistake it for trading volume and assume all liquid assets are a sure bet. They also think every cryptocurrency shares the same liquidity level—they don’t. These common mix-ups tend to obscure the finer details of liquidity and can send investors down the wrong path if left unchecked.

- Liquidity is not quite the same thing as volume. Sure, volume might be buzzing but that does not always mean high liquidity. It is a subtle yet important difference.

- Just because an asset has decent liquidity, do not assume it is automatically safe or low risk. That is not always true.

- Different cryptocurrencies and tokens can have very different liquidity levels, which can surprise even the most experienced.

- Having liquidity on your side does not guarantee profits. Market conditions and timing still determine the outcome.

How to Size Up Liquidity Before Jumping Into a Trade or Investment

Sizing up liquidity before throwing your capital into the ring helps sidestep nasty surprises like hidden costs or unexpected hold-ups. Investors tend to eye a handful of things, starting with the bid-ask spread to get a grip on transaction costs. Then there’s the depth of the order book, which shows how much volume’s stacked up at each price point—kind of like checking how stocked the shelves are before you shop. Historical trading volumes also come into play, giving a decent snapshot of the market’s usual hustle and bustle. On top of that, keeping an eye out for reputable market players and steady price action can provide some pretty solid hints about the quality of liquidity.

Take a good look at the bid-ask spread to understand transaction costs. Generally, tighter spreads indicate healthy liquidity.

Peek into the order book depth to see how much volume is present at different price points. This insight goes a long way.

Dig into historical trading volumes to get a sense of typical market activity and investor interest over time.

Make sure there are reliable market players or liquidity providers actively involved because their presence usually keeps things running smoothly.

Keep a close watch on price stability. When volatility spikes, it is often a red flag signaling potential liquidity hiccups.

Looking Ahead to Liquidity in DeFi and Beyond A Quick Dive into What’s Next

Liquidity in DeFi is becoming not just more advanced but nicely interconnected too. Emerging trends like cross-chain liquidity protocols are making asset movement across blockchains smoother. This should boost market efficiency. Aggregators tap into multiple liquidity pools and platforms to give users better prices and keep slippage at bay—something I have found is always a welcome relief. Meanwhile, new incentive models are popping up to lure more liquidity while tackling pesky risks like impermanent loss.

Useful Links

- Investopedia - Your go-to spot for sharp financial insights and market know-how

- CoinDesk - Keeping you in the loop with the freshest news on crypto and DeFi

- Ethereum Foundation - The official playbook and trusty docs for all things Ethereum

- Bank for International Settlements (BIS) - Digging into the nitty-gritty of global financial markets