BTC Stock-to-Flow Model Explained

Bitcoin's price history is famous for its rollercoaster rides, and getting a handle on how its value is cooked up can be pretty daunting for newcomers. The Stock-to-Flow (S2F) model is one neat way to link Bitcoin’s scarcity straight to its price tag.

So, what’s the Stock-to-Flow Model all about?

The stock-to-flow model is a handy tool to get a sense of scarcity and is most often used with commodities like gold and silver. "Stock" means the total amount of the commodity that is out there right now, while "flow" is the amount that gets produced each year.

The stock-to-flow ratio is basically a way to peek behind the curtain and see how much of an asset is out there compared to how much is being produced each year. When that ratio is higher, individuals usually consider the asset to be scarcer. Scarcity often nudges prices upward if something’s rare and people want it, it tends to get more valuable over time. Take gold, for instance. It boasts a high stock-to-flow ratio because most of the gold ever mined is still hanging around, with only a tiny bit added annually through mining. That slow trickle helps keep its value steady.

How Exactly Does the BTC Stock-to-Flow Model Work, Anyway?

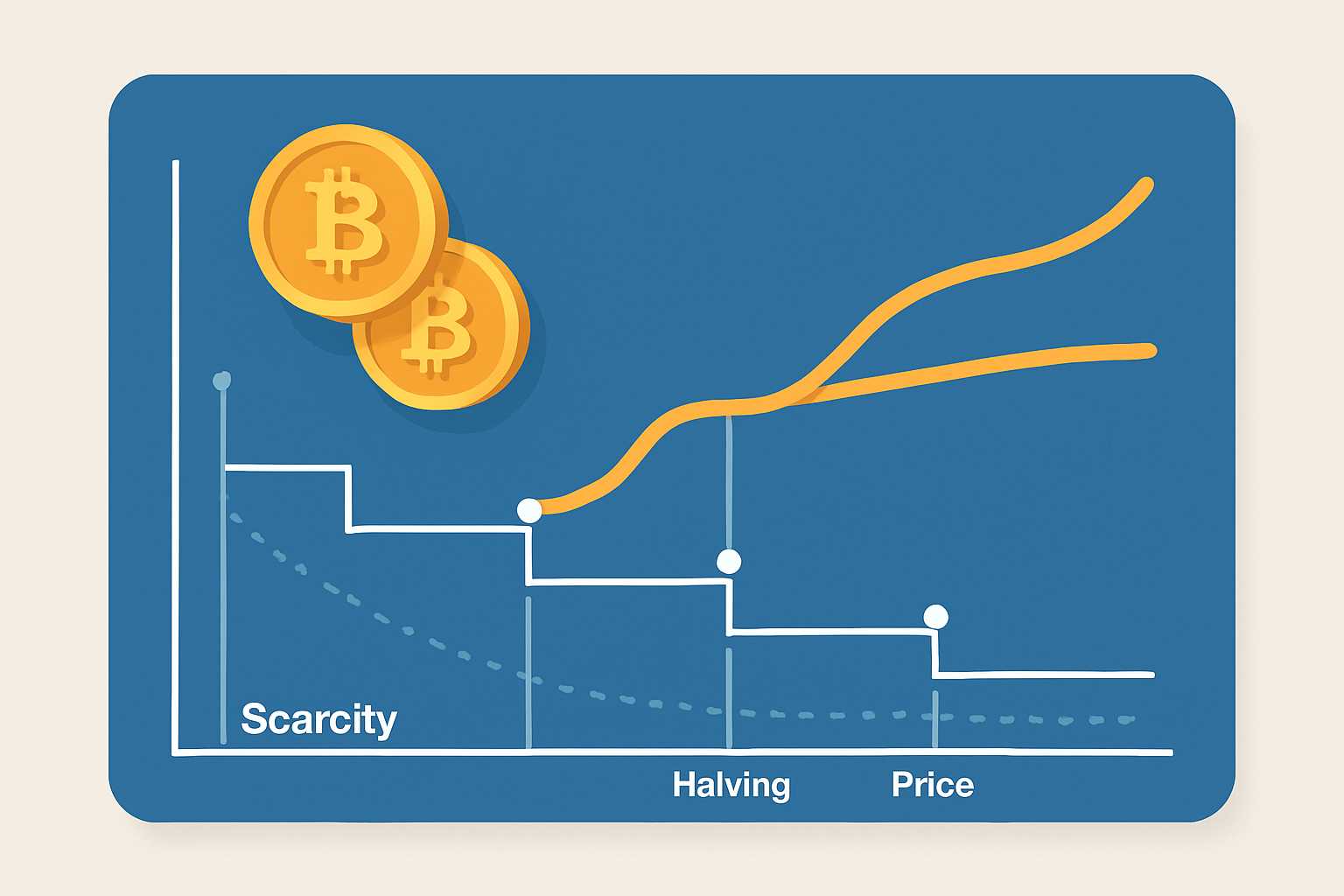

The BTC stock-to-flow model leans on the idea of scarcity but is tailored specifically to Bitcoin’s unique world. The protocol enforces a hard cap of 21 million coins for the total supply—no ifs or buts. Then roughly every four years miner rewards for adding new blocks get chopped in half.

- Bitcoin’s total supply keeps growing at a steady clip, but it will never break the 21 million coin barrier.

- Every four years or so, the number of new Bitcoins mined takes a noticeable dip thanks to halving events.

- Each halving slices the block reward miners earn in half, which means the new supply slows down quite a bit.

- This clever mechanism makes Bitcoin scarcer over time by steadily pushing up its stock-to-flow ratio, a key measure of rarity.

The model illustrates that every time the stock-to-flow ratio ticks up following a halving, Bitcoin's value tends to follow suit and climb higher. This makes sense when you think about it—Bitcoin gets scarcer, which naturally pulls in more investor attention as time goes by.

"Bitcoin is often called digital gold, and not without reason—its value largely comes down to how scarce it is. The stock-to-flow model steps in to measure that rarity, giving us a handy way to peek at Bitcoin's potential price journey over the long haul." — PlanB

The History and Origins of the BTC Stock-to-Flow Model

You know, when it comes to Bitcoin and its mysterious value dance, the Stock-to-Flow model really steals the spotlight. It’s like the backstage pass that lets us peek into why this digital gold behaves the way it does. Tracing its roots, this model did not just pop out of nowhere; it’s built on an age-old idea initially cooked up by some sharp minds who studied precious metals like gold and silver. Over time, Bitcoin stepped onto the stage, fitting this model like a glove, given its scarce supply and steady issuance. It’s kind of fascinating how an offbeat concept from the traditional commodity world found a second life in the crypto realm, showing just how creative and interconnected financial thinking can be.

The BTC stock-to-flow model shot to fame thanks to an anonymous quantitative analyst named PlanB back in 2019. By digging into Bitcoin's historical price and supply data, PlanB created this model as a clever way to estimate Bitcoin's potential price through the lens of its scarcity.

Since it first hit the scene PlanB has rolled out several versions of the model fine-tuning the calculations and stretching those predictions to cover future halvings with more finesse. The model quickly grabbed the spotlight in crypto circles mainly because it seemed to nail Bitcoin's price rallies following halving events. Some critics have tossed in their two cents questioning its assumptions and how trustworthy those predictions really are.

Strengths and Little Quirks of the BTC Stock-to-Flow Model

One of the standout strengths of the BTC stock-to-flow model is its simple, no-nonsense quantitative approach that leans heavily on Bitcoin's fixed supply schedule. It ties scarcity—a concept that’s pretty much second nature in economics—directly to Bitcoin’s price in a way that just clicks naturally.

The S2F model has gained a loyal following but often catches flak for glossing over demand-side factors like adoption rates and market mood swings and the bigger economic picture. It pretty much assumes scarcity is the sole driver of price which feels like putting on blinders to how messy and complex markets really are.

- The model tends to leave out key demand-side factors like investor sentiment and the wider economic trends that often throw curveballs.

- It doesn’t handle periods of wild market swings or surprise shocks very gracefully.

- By zeroing in almost exclusively on Bitcoin’s halving schedule, it misses out on other subtle shifts in supply and demand that quietly sneak in.

- It completely skips over regulatory changes and the impact of new technologies that could shake up the price in unexpected ways.

Common Misunderstandings About the BTC Stock-to-Flow Model Clearing Up the Confusion

A lot of individuals often fall into the trap of thinking the BTC stock-to-flow model is a crystal ball guaranteeing future price leaps. It mostly highlights correlations tied to scarcity and doesn’t provide precise price predictions. Another classic misunderstanding is mixing up correlation with cause. Scarcity plays a role in price but it’s far from the whole story.

- The S2F model doesn’t hold a crystal ball that guarantees prices will keep climbing higher.

- It doesn’t factor in every twist and turn of the market that could sway Bitcoin’s price.

- Scarcity alone can’t quite capture the full story behind Bitcoin’s market value.

- And the model won’t nail down the precise timing of price swings or those pesky short-term ups and downs.

What the Stock-to-Flow Model Really Means for Bitcoin Investors in Practice

Investors might want to think of the stock-to-flow model as one piece of a larger puzzle rather than putting all their eggs in that one basket. It’s true that higher stock-to-flow ratios usually hint at increasing scarcity, which can shed some light on potential long-term value. Still, it’s wise to balance this with other market indicators like fundamentals and sentiment—kind of like not judging a book by its cover alone.

When keeping an eye on a rising stock-to-flow ratio investors should consider it alongside Bitcoin’s price cycles and the overall market vibe. After a halving scarcity usually spikes but the price doesn’t immediately reflect that. Markets often move with a bit of lag or get nudged by external factors.

| Bitcoin Halving Date | Approximate Stock-to-Flow Ratio | Approximate Price Response |

|---|---|---|

| November 2012 | ~25 | Price jumped from $12 to over $1,000 within the next year, quite the rollercoaster |

| July 2016 | ~50 | Price soared from about $650 to nearly $20,000 by 2017, proving the hype was real |

| May 2020 | ~100 | Price surged from roughly $8,700 to more than $60,000 in 2021, making early believers smile |

This table highlights how each halving roughly doubled Bitcoin’s stock-to-flow ratio and was usually followed by notable price rallies after a bit of a wait — patience often pays off with Bitcoin.

Taking a Closer Look Ahead at the BTC Stock-to-Flow Model

The BTC stock-to-flow model looks poised to bring in extra layers like demand trends, user adoption rates and the wider macroeconomic landscape. Some analysts reckon hybrid valuation models could give us a richer picture by blending scarcity with other factors such as network activity or regulatory shifts.

The Bitcoin market steadily matures with regulatory clarity clearing up and institutions slowly jumping on board. The relevance of the btc stock to flow model might start to shift a bit. These developments tend to introduce fresh price factors that the original S2F framework may not fully account for, which means a few tweaks or entirely new approaches could be on the horizon.

Frequently Asked Questions

How accurate is the BTC stock-to-flow model in predicting Bitcoin's price?

The model has generally done a decent job tracking Bitcoin’s price moves, especially around high-drama halving events, though it’s no crystal ball. It focuses on scarcity alone and leaves out wild cards like demand, market mood swings and outside forces such as regulations and economic rollercoasters. So while it offers some solid long-term perspective on scarcity, relying on it for spot-on short-term price guesses is a stretch.

Does the stock-to-flow model guarantee Bitcoin’s price will rise after halvings?

Not quite. Halvings crank up scarcity and push the stock-to-flow ratio higher but that doesn’t magically translate into price fireworks every time. The model suggests a general uphill trend over the long haul. Yet short-term jitters, shifts in market sentiment and unexpected events can throw a wrench in the works. Think of it more like a helpful signpost rather than a sure-fire promise.

Why doesn’t the stock-to-flow model account for Bitcoin demand?

Its job is to focus on scarcity, not demand. The premise is that scarcity plays a big role in value but actual prices dance to a more complicated tune. Factors like adoption, speculation and the wider economic scene can all make a difference. Critics have a point when they say ignoring demand puts a ceiling on the model’s accuracy, especially when markets get choppy or investor moods shift.

Can the stock-to-flow model be applied to other cryptocurrencies?

Not really. Bitcoin’s fixed supply and those predictable halvings give it a special spot in the crypto lineup. Most other cryptocurrencies either don’t share this strict scarcity or have inflationary supplies so the model just doesn’t fit their playbook. It’s really tailored to Bitcoin’s one-of-a-kind economic setup.

How should investors use the stock-to-flow model in their strategy?

It’s best to treat it as just one handy tool in a bigger toolbox. Pair its insights on scarcity with fundamental checks like how widely Bitcoin is being adopted or if big institutional players are jumping in and technical indicators too. Leaning on it alone is a bit like trying to navigate with one compass. Using it along with broader market research usually leads to smarter moves, especially when halving season rolls around.

What happens to the stock-to-flow model once all 21 million Bitcoin are mined?

When all coins are finally mined, Bitcoin’s flow basically drops to zero, pushing the stock-to-flow ratio off the charts—think infinite. At that stage the model’s usefulness probably fades since scarcity will be absolute and no longer a variable factor. Valuation will likely pivot to demand-driven aspects like Bitcoin’s utility, adoption rates and its economic role though scarcity will still be a key piece of the puzzle.

Start Your Crypto Journey with Coinbase Today

Ready to enter the cryptocurrency market but unsure where to begin? Coinbase makes buying, selling, and storing digital assets simple and secure for beginners and experts alike.