How Cross-chain Interoperability Works in Crypto?

Cross-chain interoperability has become a cornerstone concept in the cryptocurrency world by enabling different blockchain networks to connect and share data or assets without a hitch. Most blockchains operate independently with unique protocols, so cross-chain interoperability acts like a bridge linking these separate islands. This feature smooths out the user experience and sparks innovation by letting liquidity flow freely and smart contracts play nice together. It also lets users explore a broader universe of decentralized finance (DeFi) applications.

So What Exactly Does Cross-chain Interoperability Mean

Cross-chain interoperability lets different blockchains shake hands and swap data. It also enables them to move assets around. Usually, blockchains act like separate islands that do not speak the same language. This disconnect can really put a wrench in moving tokens or sharing information between chains.

- Blockchains typically operate as standalone networks that stick to their own rules and handle their own assets.

- These siloed chains can create headaches for users wanting to move tokens or share data across networks.

- Cross-chain interoperability bridges these gaps and lets networks talk to each other and swap value without a hitch.

- This helps transfer assets, bring DeFi services together and expand what blockchains can do.

Why Should We Care About Cross-chain Interoperability in Crypto?

Cross-chain interoperability brings many perks to the blockchain ecosystem. It boosts liquidity by allowing assets to move seamlessly between platforms, which is a relief for anyone tired of jumping through hoops. Plus, it smooths out the user experience by making it easy to access different networks without hassle. On top of that, it opens the door for decentralized applications (dApps) to mix features from various blockchains and create some nifty combos. Just as importantly, interoperability supports scalability by spreading workloads across multiple chains.

- Pools liquidity from a bunch of different blockchains, squeezing every bit of available capital for maximum impact.

- Makes it a breeze to share resources and vital data across various networks, bridging gaps you might not have noticed before.

- Opens up exciting new cross-chain DeFi opportunities, including multi-chain lending and yield farming that really push the envelope.

- Fosters a spirit of collaboration across blockchains, helping to build a more resilient and connected ecosystem.

- Stands up against those isolated, siloed blockchain systems that often put a damper on adoption and flexibility.

Key Mechanisms That Make Cross-chain Interoperability Actually Work

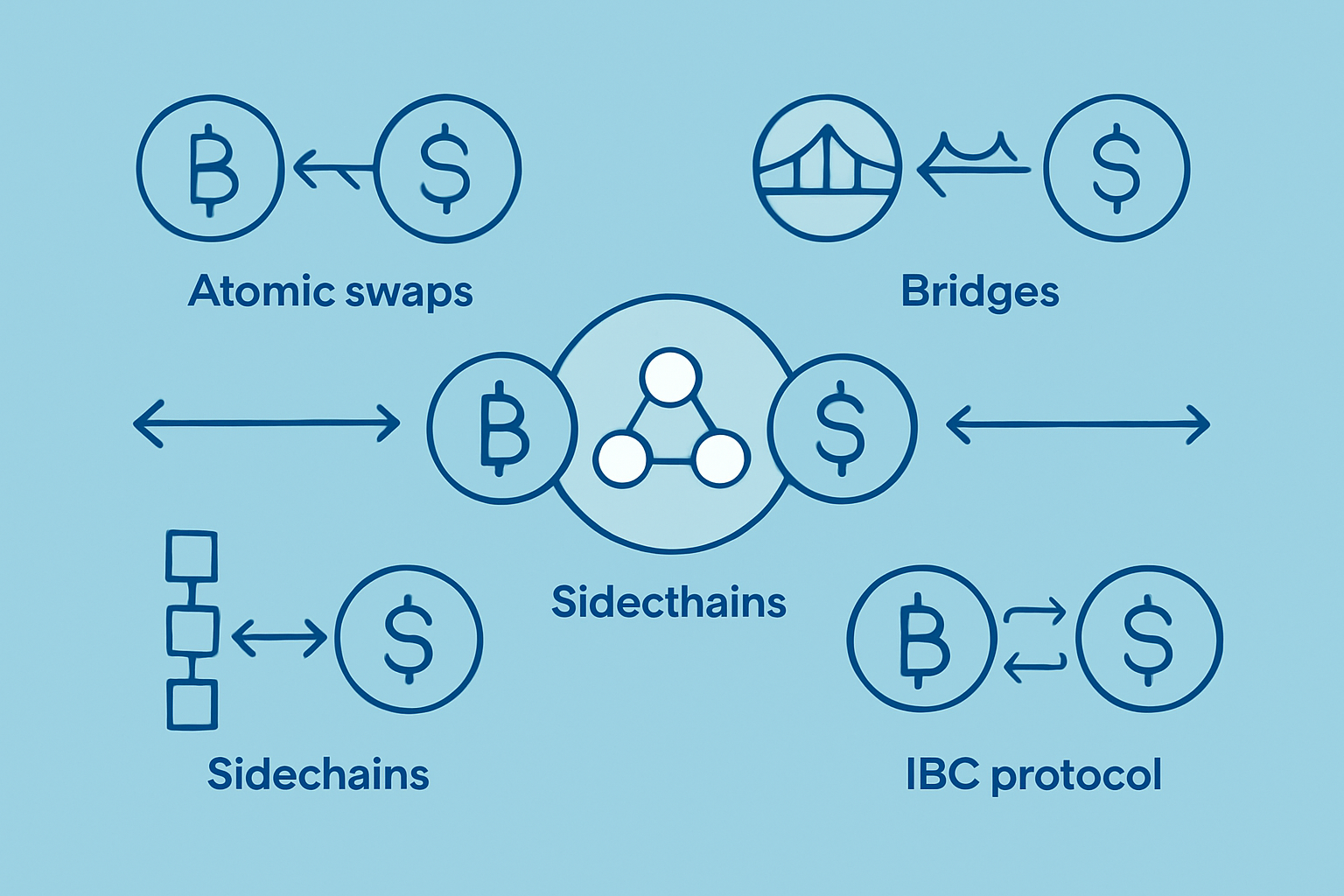

There are quite a few technical tricks up the sleeve that make cross-chain interoperability possible, each charting its own unique path to link separate blockchains. These can be anything from straightforward peer-to-peer token swaps to the more complex, carefully crafted protocols that securely verify and shuttle data between networks.

Atomic swaps let you trade tokens directly between two different blockchains without the hassle of a middleman.

Cross-chain bridges rely on clever protocols or smart contracts to lock tokens on one chain and create matching tokens on another. This makes the process feel almost magical.

Relay chains act as trustworthy middle blockchains that verify and shuttle cross-chain transactions smoothly.

Sidechains are like trusty sidekicks to main chains. They are separate blockchains that help move assets while sharing security.

Hash time-locked contracts (HTLC) are smart contracts with a ticking clock. They keep atomic swaps secure and timely.

Inter-blockchain communication (IBC) protocols are standardized messengers that let blockchains chat directly. This makes cross-chain communication a breeze.

Taking a Closer, More Thoughtful Dive into How Each Cross-chain Solution Really Works

We will dive into each method with a fine-tooth comb, using simple analogies that break down those head-scratching cryptographic processes.

- Atomic swaps are trustless exchanges where two parties trade tokens simultaneously on their own separate chains to ensure neither side can pull a fast one. It’s like a handshake that happens without either person letting go early.

- Bridges act like digital lockers that securely lock tokens on one chain while creating or releasing matching tokens on another. Think of it as a well-guarded vault with a twin on the other side.

- Relay chains keep an eye on multiple chains, verify transactions, and then send off confirmations. They’re the diligent middlemen making sure nothing slips through the cracks.

- Sidechains are like the trusty sidekicks of a main chain. They’re linked closely yet run their own show. They let assets move back and forth smoothly while handling their own special functions on the side.

- HTLCs set up contracts with deadlines that automatically flip transactions back if conditions aren’t met in time. This adds an extra layer of security to swaps. It’s a bit like a safety net catching you if the deal falls through.

- IBC protocols provide a common language and set of rules so blockchains can chat and exchange data effortlessly, much like the internet’s protocols ensure we all speak the same digital lingo.

When someone wants to swap Bitcoin for Ethereum tokens through a bridge, their BTC gets locked up in a smart contract on the Bitcoin chain. This move then nudges the bridge to mint or release an equivalent amount of Ethereum tokens on the Ethereum network. From the user's perspective, the whole transfer feels pretty smooth and straightforward.

Typical Challenges and Risks in Cross-chain Interoperability

Navigating the maze of cross-chain interoperability is no walk in the park. While it promises a shiny future of seamless blockchain communication, it’s riddled with its own set of tricky challenges and lurking risks that can trip up even the savviest developers and users. From technical hurdles to security pitfalls, getting these diverse systems to chat smoothly is a bit like convincing cats and dogs to agree on a dinner menu. Let’s dive into some of the common headaches and risks that come with this brave new world.

Cross-chain interoperability definitely holds a lot of promise though it’s not without its fair share of headaches. Security risks especially with bridges have led to major hacks and substantial user fund losses—something that’s hard to ignore. Different blockchains speak unique languages and use varied protocols. This often turns integration into a tangled mess. Cross-chain transactions can drag on painfully slow and the added complexity tends to gum up the user experience.

- Bridge hacks keep tripping up the industry, causing billions in losses thanks to those pesky vulnerable smart contracts.

- The smorgasbord of blockchain protocols out there means compatibility issues and a real headache when it comes to standardization.

- Cross-chain transactions can be a bit like watching paint dry sometimes, with delays that slow things down and leave users tapping their fingers.

- Clunky and complicated user interfaces often scare people off, making adoption tougher and upping the odds of mistakes.

- The patchwork of governance styles and fuzzy regulations across different chains keeps throwing up compliance roadblocks that seem to never quite go away.

Security really ought to be the bedrock of every cross-chain interoperability solution. Thoughtful smart contract audits, robust validation processes, and designs that cleverly cut down on trust requirements all team up to keep user funds safe and steadily build trust in the ecosystem. In my experience, you can never be too careful when it comes to protecting what matters most.

A Quick Tour

A handful of projects have taken the reins in the cross-chain interoperability arena each bringing their own unique spin to connecting blockchains and expanding decentralized ecosystems. These projects aren’t just shuffling assets back and forth—they also support shared security, set up communication standards and unlock cross-chain DeFi features that push the industry forward.

| Project Name | Interoperability Method | Supported Blockchains | Notable Features | Use Cases |

|---|---|---|---|---|

| Polkadot | Relay chain and parachains | Ethereum, Bitcoin, and others through bridges | Offers shared security wrapped up in a scalable multi-chain network | Ideal for cross-chain dApps, DeFi adventures, and rolling out custom blockchains |

| Cosmos | IBC protocol | Cosmos SDK chains and Ethereum via bridges | Brings a standardized way for blockchains to chat with each other | Perfect for token transfers and multi-chain DeFi magic |

| Thorchain | Cross-chain bridge and swaps | Bitcoin, Ethereum, Binance Smart Chain, and more | Features native liquidity pools paired with decentralized swaps | Great for cross-chain asset swaps and fueling DeFi liquidity pools |

| Avalanche | Subnets and bridges | Ethereum, Bitcoin, and Avalanche C-Chain | A highly scalable platform that plays nicely with Ethereum assets through bridges | Suited for cross-chain DeFi and vibrant NFT marketplaces |

| Wormhole | Cross-chain bridge | Solana, Ethereum, Binance Smart Chain, Terra, and others | Fast, decentralized messaging and asset bridging that keeps things moving | Seamlessly enables token transfers and interoperability in the Solana ecosystem |

| Ren Protocol | Cross-chain bridge | Bitcoin, Ethereum, Binance Smart Chain, and others | Delivers trustless token wrapping across multiple blockchains — making life easier | Helps bring Bitcoin liquidity straight to DeFi platforms |

- Polkadot uses a relay chain design that lets multiple connected parachains chat securely with one another like a well-organized neighborhood watch.

- Cosmos leans on the Inter-Blockchain Communication (IBC) protocol to set up a common language for blockchains to exchange messages. It feels like a smooth group text rather than a chaotic relay.

- Thorchain zeroes in on decentralized non-custodial liquidity pools that enable seamless cross-chain token swaps—think of it as a trustworthy middleman who never holds your keys but always has your back.

- Avalanche puts a spotlight on customizable subnets that link up to Ethereum. It offers a flexible and scalable playground for interoperability as adaptable as a multi-tool.

- Wormhole delivers a speedy cross-chain bridge primarily connecting Solana with other major blockchains like a well-oiled express lane for assets.

- Ren Protocol brings trustless cross-chain asset transfers, especially wrapping Bitcoin so it can mingle freely in Ethereum’s DeFi party.

Guidelines for Using Cross-chain Interoperability Securely

Navigating the world of cross-chain interoperability can feel a bit like juggling flaming torches—exciting but you definitely want to keep your wits about you. Here are some practical pointers to help you handle it safely and smartly.

When diving into cross-chain interoperability tools, it’s wise to keep security front and center and understand the risks at play. A little caution goes a long way. Pick bridges with solid reviews, start with small transfers and stay on top of platform updates to minimize potential losses. It’s smart to watch for any smart contract hiccups and avoid handing over control to centralized custodians whenever you can.

- Whenever you can, stick to bridges and interoperability tools that have passed the tough scrutiny of third-party security audits. It’s better to be safe than sorry.

- Keep an eye on the risks that come with smart contracts and make it a habit to stay in the loop with any security alerts from the projects you’re involved with. It’s like keeping your ears to the ground in a busy town.

- Start out small with test transactions to make sure everything’s running smoothly before you dive in with larger amounts. A little caution here goes a long way.

- Always keep your software, wallets and keys up to date and shield them from malware or phishing scams—they’ve become quite the crafty pests lately.

- Whenever you can swing it, go for non-custodial options that let you keep a tight grip on your assets instead of handing them over to some centralized middleman.

What the Future Holds for Cross-chain Interoperability

The future of cross-chain interoperability is shaping up to be an exciting ride as standards fall into place and fresh innovations appear. New protocols make integration less of a headache, ramp up security with trust-minimized or trustless tactics, and boost scalability by helping networks play nicely together. As interoperability matures, it should boost blockchain adoption by tearing down walls between ecosystems and sparking more composability in decentralized finance. Its reach will expand beyond financial assets to identity, supply chains, and gaming.

Seamless interoperability between blockchains often turns out to be the secret sauce for unlocking the true potential of decentralized ecosystems. It opens the door to fresh waves of collaboration, sparks innovative ideas, and hands more power to users all across the crypto landscape.