How THORChain Enables Native Asset Swaps

In the ever-shifting world of blockchain and decentralized finance (DeFi), being able to swap digital assets smoothly across different blockchains is no small feat. THORChain shines as an innovative protocol that cuts through the noise by enabling native asset swaps. This means exchanging cryptocurrencies in their original form without relying on wrapped or pegged tokens. This trick plays a huge role in keeping things genuinely decentralized, trustless and efficient for cross-chain transactions.

Interoperability means different blockchain networks can chat and collaborate smoothly like old friends catching up rather than strangers awkwardly passing notes. Some key ideas include "native assets"—cryptocurrencies that live on their own blockchain like Bitcoin on the Bitcoin network—and "cross-chain swaps," which means swapping assets between different blockchains. This is where THORChain really shines. Instead of using wrapped or pegged assets like usual approaches, THORChain lets you swap native assets directly, preserving the true essence and security of these cryptocurrencies without any funny business.

So, What Exactly Are Native Asset Swaps Anyway

Native asset swaps involve trading cryptocurrencies right on their own blockchains, without the hassle of wrapping them up or turning them into synthetic versions. This method usually cuts down on unnecessary complexity and steers clear of the usual risks that pop up with bridging technologies.

- Native assets are cryptocurrencies created and operating on their own blockchain networks. Think of Bitcoin (BTC) running on the Bitcoin network or Ether (ETH) existing on Ethereum.

- Wrapped tokens are like the cosmopolitans of crypto. They are versions of cryptocurrencies living on different blockchains while still representing the original asset, such as Wrapped Bitcoin (WBTC) on Ethereum.

- Native swaps avoid usual headaches like counterparty risk and trust issues common with wrapped tokens. This approach provides a boost to security and decentralization.

- For example, when swapping BTC for ETH natively, Bitcoin isn’t wrapped or tokenized. It remains true to itself and keeps all its original security advantages and unique network characteristics that make it special.

THORChain Explained A Slightly Less Mysterious Look Under the Hood

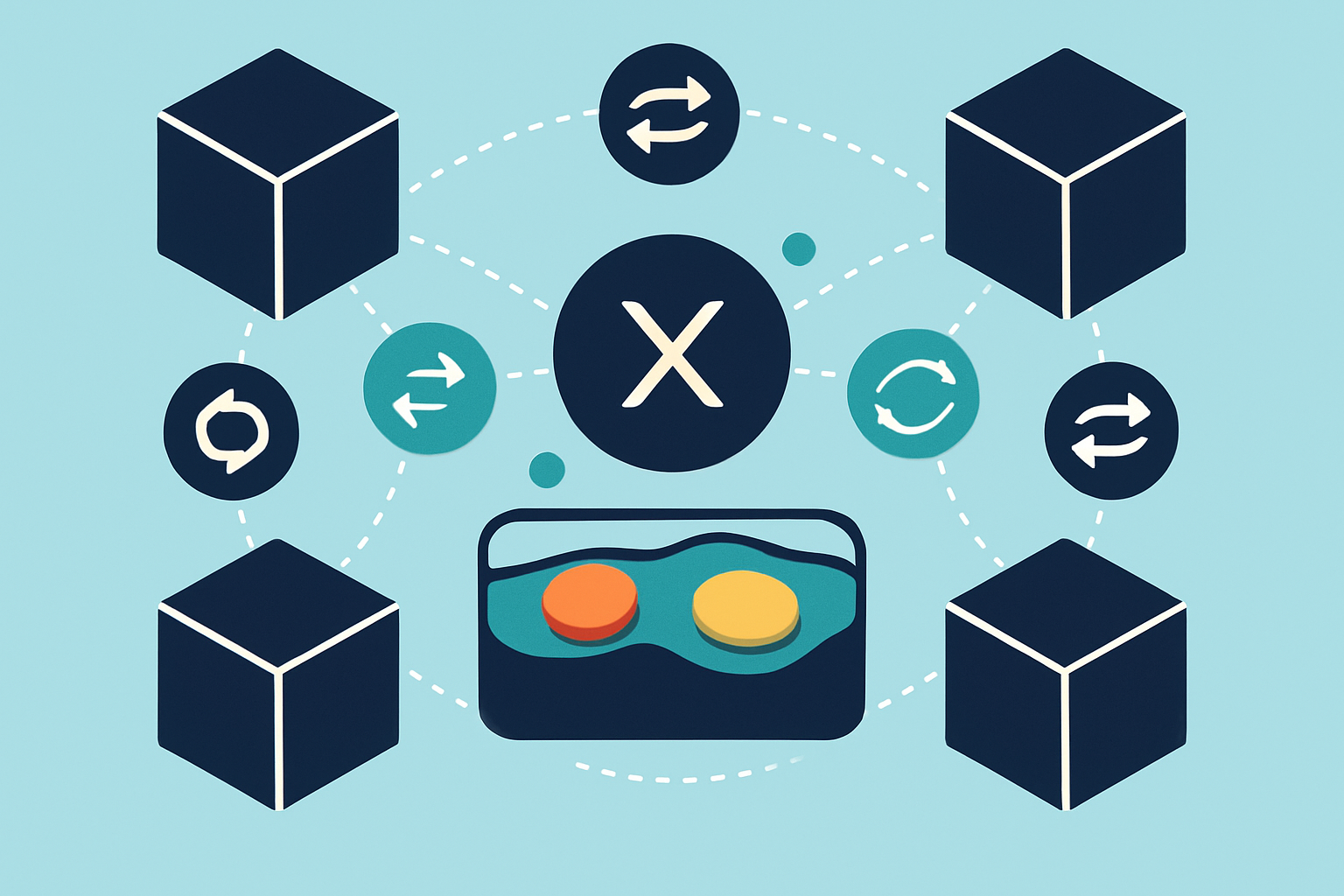

THORChain is a decentralized liquidity protocol that lets users swap native assets across a cross-chain liquidity network with ease. It allows direct asset trading without users having to hand over custody or rely on centralized middlemen, supporting trustless and permissionless swaps between different blockchains.

Liquidity Provision: Users pitch in their native assets to THORChain's liquidity pools that lay the groundwork for making swaps possible.

Continuous Liquidity Pools (CLPs): CLPs keep things flexible with dynamic pricing and steady liquidity so swaps stay smooth and ready whenever you need them.

Swap Execution: THORChain steps in to seamlessly match and finalize the trade through these liquidity pools.

Incentives for Liquidity Providers: The individuals who chip in liquidity earn fees and rewards that encourage more participation and keep the whole network humming along nicely.

Security via Nodes: A decentralized crew of validators known as nodes keeps the system safe by running the protocol and double-checking transactions to make sure the network’s integrity stays rock solid.

THORChain relies on a Byzantine Fault Tolerant Tendermint consensus for its node setup. These nodes operate in a fully decentralized fashion, tirelessly validating transactions and juggling liquidity across various blockchains. This smart approach not only fortifies the protocol but also keeps cross-chain operations running like a well-oiled machine

How Native Asset Swaps Actually Work on THORChain

THORChain works its magic with native asset swaps using continuous liquidity pools that keep cryptocurrencies on their original blockchains. When you ask for an exchange, the protocol jumps into action and pulls from these pools and validator nodes to move assets safely and directly between blockchains.

- Continuous Liquidity Pools (CLPs) cleverly adjust asset prices based on supply and demand, making sure swaps happen fairly at just about any time you want.

- Liquidity providers chip in by depositing native assets into these pools, helping keep things running smoothly with enough liquidity for all those swaps.

- Swap fees paid by users are shared with liquidity providers as a nice little thank-you, encouraging them to stick around and keep the system healthy.

- THORChain validators take care of cross-chain settlement, expertly coordinating transactions across different blockchains in a completely trustless way.

- The whole process is non-custodial, so users hold the reins and keep full control of their assets right up until the swap is done and dusted.

Say a user wants to swap Bitcoin for Ethereum. The Bitcoin they hand over goes into the BTC liquidity pool while THORChain’s validator nodes do their magic and release the right amount of ETH from the ETH pool straight to the user's wallet.

Using THORChain to swap native assets is kind of like trading cold hard cash straight up. It cuts out the middlemen—no need for gift cards or vouchers slowing things down—so the whole process feels quicker, more secure, and just plain cleaner. Plus, you get to hold onto real ownership, riding the wave of trustless transactions the entire way.

Why THORChain Shines When It Comes to Native Asset Swaps

- THORChain nails true decentralization by cutting out pesky centralized middlemen in cross-chain trading.

- Users get to swap native assets directly which significantly cuts down on counterparty and custodial headaches.

- Liquidity pools hold real native assets boosting not just efficiency but reliability too—no funny business here.

- The protocol provides a slick hassle-free experience letting users seamlessly swap assets across multiple blockchains natively and ditch the usual messy bridges.

- Liquidity providers rake in rewards from fees and have their say in governance keeping the ecosystem lively and buzzing.

- Best of all the protocol throws open the doors to everyone without needing permission championing inclusivity and spreading financial opportunity far and wide.

These benefits tackle some of the common headaches found with other interoperability solutions that often rely on wrapped tokens or centralized custody. Those setups can create vulnerabilities, raise trust issues, and harm liquidity.

Challenges and Risks Linked to THORChain You Should Keep in Mind

THORChain offers some impressive features though it is not without hurdles. Both users and developers should watch out for risks like impermanent loss for liquidity providers and potential weak spots in smart contracts. There is also the ever-looming threat of network attacks. Newcomers often find the cross-chain swap process daunting.

- Liquidity providers often face impermanent loss when asset prices change between the time they deposit and when they eventually withdraw. It is one of those tricky risks that can catch you off guard.

- Smart contracts are powerful, but they can sometimes have bugs or hidden vulnerabilities that cause security issues. Nobody's perfect, not even code.

- The network itself is not completely safe either. It can be targeted by attacks like sybil attacks or other sneaky economic exploits that make you want to double-check your defenses.

- For newcomers, the multi-step swap process combined with linking wallets can feel like navigating a maze. It is definitely more complicated than just clicking a button.

- Liquidity is sometimes spread across different pools which usually lowers overall trading efficiency. It is like spreading yourself too thin and hoping for the best.

THORChain’s community and developers are constantly rolling up their sleeves to improve security audits and fine-tune user interfaces. They also add helpful educational resources along the way. Their governance processes make sure the protocol can keep pace with new threats and usability quirks.

Getting Started with Native Asset Swaps on THORChain A Friendly Guide to Jump Right In

Starting with native asset swaps on THORChain-powered platforms is generally straightforward even if you’re new to this world. Users just need to connect a compatible wallet and choose the assets they want to swap. Then they can review the swap details quickly before hitting execute.

Set up a supported cryptocurrency wallet like MetaMask or XDEFI Wallet that works well with multiple blockchains.

Load your wallet with some native assets such as BTC, ETH or BNB so you’re ready for swapping.

Visit a THORChain-powered decentralized exchange like Symbiosis or THORSwap.

Choose the asset you want to swap and select the one you would like to receive.

Before confirming, take a moment to carefully check the transaction details including estimated fees and expected output to avoid surprises.

After confirming, watch the transaction status using a blockchain explorer until it completes successfully. It is always a relief when it goes through smoothly.

Popular platforms like THORSwap and Autobahn Network bring user-friendly interfaces built on THORChain’s protocol, making native asset swaps a breeze for regular users. These handy tools hook up with wallets and dish out real-time price quotes.