What Are Crypto Wallets and How They Work?

Cryptocurrency has truly shaken up the way we think about money, turning it into a completely digital asset guarded by cryptography. A common question that tends to pop up early on is what crypto wallets actually are.

This article walks you through the basics of crypto wallets in plain and easy-to-grasp terms. We’ll dive into what they do and how they work behind the scenes. We’ll also explain why they become must-have tools for anyone dabbling in cryptocurrency. To keep things light and approachable we’ll lean on familiar comparisons and real-world examples.

Getting to Grips with Crypto Wallets

A crypto wallet is your digital sidekick, built to help you safely stash and manage your cryptocurrencies. Unlike your usual wallet that bulges with cash and cards, this one holds the cryptographic keys—those vital little codes you need to get to your funds out there on the blockchain.

Understanding how crypto wallets operate means getting to know their main parts: public keys, private keys, wallet addresses and seed phrases. Each one has a job to do that helps you send, receive and keep your cryptocurrencies safe.

- The public key is like your email address for crypto. It is what you share freely so people can send you cryptocurrency without any issues.

- The private key is your secret handshake. It gives you full control over your funds and must be kept completely secure.

- Wallet addresses are shortened, more user-friendly versions of public keys. They make transactions smoother and help you avoid awkward mistakes.

- The seed phrase acts as your safety net. It is a backup list of words you can rely on to recover your wallet if your device goes missing.

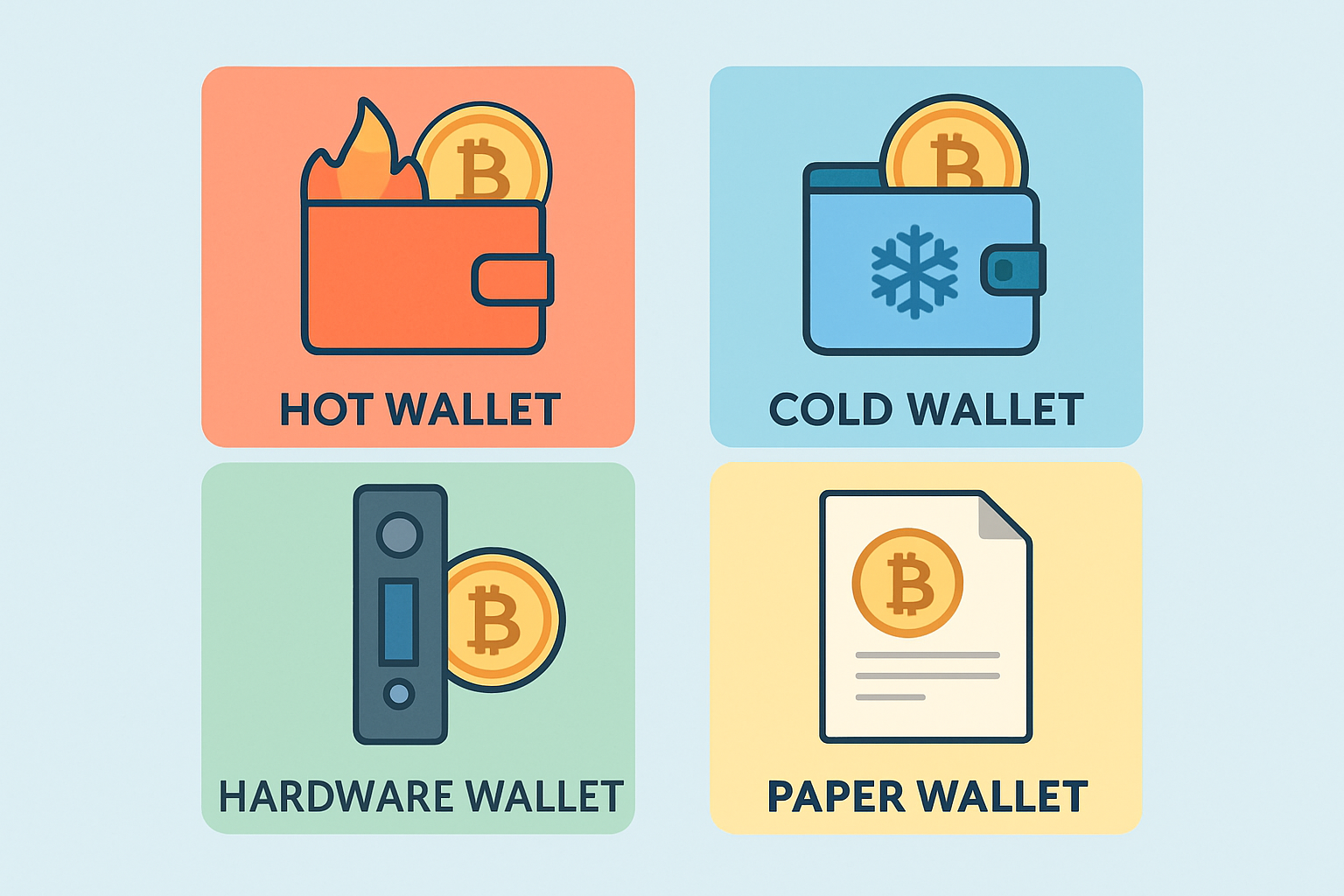

Different Kinds of Crypto Wallets A Quick Dive

Crypto wallets come in a few flavors depending on how they store your cryptographic keys and whether they are connected to the internet. Generally, wallets fall into two big camps: hot wallets that stay online for fast and easy access and cold wallets that keep your keys offline like a secret hideout to improve your security.

- Hot wallets are software wallets connected to the internet making them super quick to access but they are more vulnerable to hackers.

- Cold wallets keep your keys offline giving you a solid shield against digital threats though they are not convenient for regular use.

- Hardware wallets are nifty gadgets designed to keep your keys safe from online threats like a digital fortress you can hold.

- Paper wallets involve printing your keys on paper. It is old-school but effective for storing keys physically to avoid internet-related risks.

How Crypto Wallets Actually Work (No Magic, Just Tech)

Crypto wallets don’t really store the cryptocurrencies themselves. Instead, what they actually keep under lock and key are the cryptographic keys—those secret codes that prove you own your coins and give you the access to handle them on the blockchain.

When you set up a wallet it creates a cryptographic key pair: a public key that lets you receive funds and a private key that lets you spend them—like having a mailbox and the only key to unlock it.

Your public key also generates your wallet address, which you share with others when you want to receive cryptocurrency—think of it as your digital front door.

When it’s time to send coins your wallet uses the private key to digitally sign the transaction as proof the funds are yours—a bit like signing a check but more high-tech.

Meanwhile the wallet software connects to the blockchain network to check your balance and line up your transactions keeping everything shipshape.

Once your transactions are signed and sealed they’re sent to the blockchain network where miners or validators give them the official stamp of approval and add them to the blockchain forever.

Breaking down these steps helps to paint a clear picture: crypto wallets are like your trusty secure gateway to the blockchain. They don’t actually hold your funds, which can be surprising at first but instead let you prove ownership and control how your cryptocurrency moves in a way that’s both secure and cryptographically verified.

Why Crypto Wallets Really Matter When It Comes to Your Security

Owning cryptocurrency essentially boils down to having full control over your private keys. That’s why crypto wallets matter so much—they act as your trusty gatekeepers and keep your funds safe from theft, loss or hacks we all worry about.

- Always treat your private keys like the crown jewels. Keep them locked down tight and never hand them out to anyone, no matter what the story is.

- Keep in mind that hot wallets are plugged into the internet, making them vulnerable to cyberattacks. It is wise to avoid storing large amounts of cryptocurrency there.

- Cold wallets are usually the safer choice when holding a significant amount of crypto for the long term because they greatly reduce the chances of hackers getting their grubby hands on it.

- Take backing up your seed phrase seriously. Losing both your device and that key phrase is basically like throwing your funds into a black hole, gone forever with no chance to recover.

Think of your crypto wallet as a safety deposit box tucked away in a vault. The private key is literally the one and only key to that box, and if it slips through your fingers, well, you’re locked out for good. Keep it under lock and key—no one else can wave a magic wand and get your funds back for you.

Picking the Right Crypto Wallet for Your Needs (Without Losing Your Mind)

Picking the right crypto wallet boils down to what suits you best. It depends on how much you value security and how often you plan to access your funds. Consider which cryptocurrencies you want to keep and how comfortable you are navigating wallet tech.

- It’s wise to weigh wallet security and user reputation before settling on one.

- Reflect on whether a mobile, desktop, hardware or paper wallet suits your day-to-day needs best.

- Check how user-friendly the wallet really is and see if there’s dependable customer support when you need help.

- Double-check that the wallet supports the cryptocurrencies you hold and integrates with the exchanges or apps you use.

Popular hot wallets like MetaMask and Trust Wallet are known for being quite user-friendly, which makes them a great pick for beginners who want straightforward access and the flexibility to handle a variety of cryptocurrencies. On the flip side, hardware wallets such as Ledger Nano X and Trezor really shine when it comes to security. They are perfect for investors managing larger sums who want that extra peace of mind. Then there are paper wallets, which can serve well as backups.

A Step-by-Step Guide to Using a Crypto Wallet

Let's walk through the process of using a crypto wallet together. Whether you are just dipping your toes into the world of digital currency or looking to sharpen your skills, this guide aims to make the journey a bit smoother and, hopefully, a little less daunting.

If you’re new to crypto wallets, taking a clear step-by-step approach to setting up and using one can really help clear up any confusion—I’ve been there. This straightforward guide gently walks you through a typical software wallet setup from installation to making those first transactions.

Kick things off by downloading a trusted wallet app from its official website or your app store. Or, if you’re cautious and prefer to keep things unplugged, go for a hardware wallet instead.

Fire up the wallet and create a new account. You’ll be handed a seed phrase. Write it down carefully and stash it somewhere safe, preferably offline. This little phrase is your lifeline.

Next, confirm your seed phrase by typing it back exactly as shown to make sure your backup is solid.

To receive cryptocurrency, simply share your wallet address with the sender. If you want to keep things slick, QR codes make this step a breeze.

When it’s time to send crypto, plug in the recipient’s wallet address exactly as it appears and sign off the transaction with your private key. A quick double-check here can save you a world of trouble later.

Start off with small test transactions just to double-check that everything’s running smoothly. Make sure your wallet software is always up to date—after all, patches often fix those sneaky security holes.

Common Myths and Misunderstandings About Crypto Wallets That Just Will not Quit

There’s no shortage of misconceptions swirling around crypto wallets that can easily trip up or scare off newcomers.

- Many individuals mistakenly believe that wallets physically hold cryptocurrency coins when in reality they simply store the access keys. It’s a subtle but important distinction that can trip up newcomers.

- Some people confuse wallets with exchanges or custodial platforms. They are quite different and mixing them up can lead to headaches.

- Assuming all wallets offer the same security is a classic pitfall that overlooks differences between hot wallets and cold wallets. It’s a bit like comparing a screen door to a safe.

- Many modern wallets are user-friendly and designed with beginners in mind. So no need to panic if you’re not a coding ninja.

Clearing up these common myths about what crypto wallets are can really help you make smarter choices when it comes to picking and protecting your crypto wallet.