What Does Fungible Mean Compared to Non Fungible Tokens

Getting a handle on fungibility versus non-fungibility is pretty vital if you want to truly grasp the key differences between fungible tokens and non-fungible tokens.

What Does Fungible Mean

fungible is a fancy way of saying that something can be swapped out or replaced by another item of the same kind, with no one batting an eye. Think of it like cash in your wallet — a $20 bill is pretty much the same as any other $20 bill. Whether it’s money, stocks, or even barrels of oil, if it’s fungible, one unit is good as another, plain and simple. This little word packs a punch in economics and law, even if it sounds a bit technical at first blush.

Fungibility is all about the knack an asset has for being swapped out unit for unit—each one as good as the next when it comes to type and value. No single unit stands out from the crowd in any significant way.

- Cash like $10 bills is fungible because each bill holds the same value and can be swapped for another without breaking a sweat.

- Gold bullion is considered fungible since one ounce of pure gold is just as good as any other ounce of pure gold—no strings attached.

- Shares of stock in a company are fungible because each share represents an equal slice of the ownership pie.

- Cryptocurrencies such as Bitcoin and Ethereum are fungible tokens meaning one unit can be exchanged for another much like swapping baseball cards but with way more at stake.

Fungibility is a big deal because it keeps trading simple. When items are fungible you can swap them without checking if each one is a special snowflake. This feature is a cornerstone in finance and commerce because liquidity and reliable standards keep markets humming smoothly. In the realm of digital assets fungible tokens act just like currency and make transactions a breeze.

What You Might Find Surprising

Non-fungibility refers to assets that are truly one of a kind and can’t simply be swapped for something else on a one-for-one basis. Non-fungible tokens or NFTs are digital tokens stored on a blockchain that represent ownership of these unique assets. Unlike fungible tokens, NFTs are genuinely unique. They allow you to verify ownership, authenticity and history thanks to the blockchain’s transparent ledger.

- Each one stands alone in its uniqueness, no two alike.

- They’re indivisible, so no selling off tiny pieces here.

- Securely etched onto the blockchain for everyone to see.

- Giving you confidence that the digital asset really is the genuine article.

NFTs have really taken off in areas like digital art collections, virtual real estate and gaming items, collectibles and music copyrights.

Main Differences Between Fungible and Non-Fungible Tokens A Quick Dive

| Aspect | Fungible Tokens | Non-Fungible Tokens (NFTs) |

|---|---|---|

| Interchangeable | Yes; these tokens can be swapped one-for-one without a fuss | No; each token flaunts its own unique flair and value |

| Divisibility | Often broken down into smaller chunks to fit different needs | Stays whole, like a rare gem that you don’t want to cut up |

| Uniqueness | Nope; every token is basically a twin in a sea of equals | Absolutely; each NFT stands alone, clearly one of a kind and easy to spot |

| Use Cases | Currency, commodities, and tradable assets that keep the economy ticking | Digital art, collectibles, gaming loot, and property—places where uniqueness shines |

| Value Retention | Rides the rollercoaster of market supply and demand | Hinges on how rare and original it is, plus its backstory |

These differences really shape the way tokens are traded and perceived. Fungible tokens usually keep things liquid and make transactions pretty straightforward, while NFTs stand out as unique badges of ownership and collectible treasures that often gain value depending on demand and how rare they are.

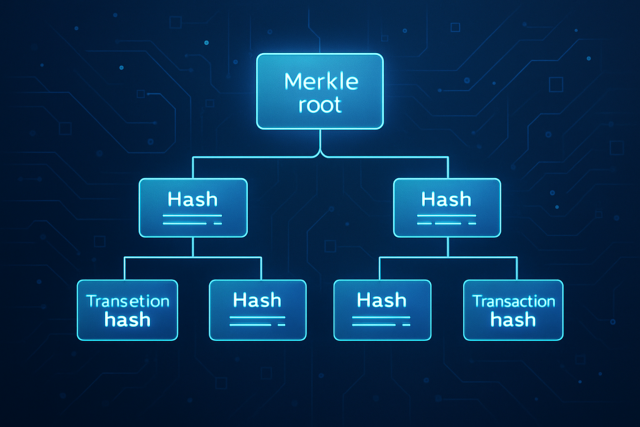

The Importance of Fungibility in Blockchain and Digital Assets

When you really stop and think about it, fungibility is the unsung hero in the world of blockchain and digital assets. It’s that quality that makes one unit exactly interchangeable with another—like how one dollar bill holds the same value as another, no questions asked. Without this, the whole system could get pretty messy, and honestly, it might fall apart faster than you can say “blockchain.” Sure, it sounds a bit technical, but at its heart, fungibility keeps transactions smooth and fair, helping to build trust in an otherwise complex digital space.

Fungibility is what lets cryptocurrencies behave like actual money, ensuring one token can be swapped for another without any loss in value or usefulness.

Fungibility works like this: you can swap one $10 bill for another without giving it a second thought, but a rare, signed baseball card isn’t exactly something you can just trade for any old card. Its unique identity and special value make it one of a kind, something you just cannot replace.

Why Non-Fungibility Quietly Steals the Spotlight in Shifting Digital Ownership

Non-fungibility gives digital assets their own unique fingerprints and official ownership records on blockchains. This shakes up the old-school notions of digital ownership which often fall short when it comes to proving who really owns what.

- NFTs give artists and content creators a lot more control, along with a genuine chance to pocket royalties when their work changes hands again.

- They bring digital scarcity to the table, making it actually possible to have limited edition digital items that feel special.

- NFTs open doors to fresh investment opportunities that go beyond the usual stock and bond shuffle.

- They up the ante in gaming by offering verifiable in-game assets that players can truly call their own, no strings attached.

- NFTs help nail down provenance, which goes a long way in cutting down on forgery and piracy in the digital world.

NFTs are truly one of a kind, they turn digital collectibles and assets into sought-after treasures that often grow in value as more individuals get drawn to their unique charm.

Common Misunderstandings About Fungible and Non-Fungible Tokens Clearing Up the Confusion

- NFTs often get written off as just overpriced digital art with not much real-world use.

- Fungible tokens don’t carry unique value since they’re interchangeable like swapping one dollar bill for another.

- Most cryptocurrencies fall into the fungible camp but there are a few notable exceptions that break the mold.

- NFTs usually pop up as collectibles more than practical items, like digital trading cards instead of everyday tools.

- Every now and then fungible tokens represent unique rights or assets, adding spice to the mix.

NFTs first burst onto the scene because of digital art but they actually cover a much broader range of practical uses. Think property deeds or licenses to start with. Fungible tokens are interchangeable by nature, yet they can still represent distinct values like governance rights or platform utilities. That might sound a bit paradoxical at first. To keep things interesting, not every cryptocurrency is completely fungible. Some experimental tokens cleverly combine features of both fungibility and non-fungibility.

How to Tell if a Token Is Fungible or Non-Fungible A Handy Guide

To figure out whether a token is fungible or non-fungible you’ll want to check its blockchain standards, metadata, divisibility and design. Fungible tokens usually stick to standards like ERC-20. NFTs often lean on standards such as ERC-721 or ERC-1155. These allow for the uniqueness and indivisibility that make each one stand out from the crowd.

Usually ERC-20 tokens are your run-of-the-mill fungible ones while ERC-721 and ERC-1155 tend to house unique non-fungible treasures.

Take a good look at the token's metadata for any quirks or unique touches like artwork or serial numbers that make it stand out.

Fungible tokens usually play nice with that but NFTs? Not so much. They prefer to stay whole.

The token's main gig is whether it’s designed to swap hands as currency or showcase some collectible swagger.

Peek at trusted marketplaces or the official token documents to double-check details and avoid surprises.

Bitcoin operates much like an ERC-20 fungible token where each unit is interchangeable and carries the same value. It can be traded or chopped up into smaller pieces without breaking a sweat. On the flip side, you’ve got CryptoKitties where every token is a one-of-a-kind digital feline with unique traits. It cannot be sliced or swapped evenly like Bitcoin can.

What Does Fungible Mean for How You Participate in the Blockchain Ecosystem? Just a heads-up—this little word packs a punch when you get into the nitty-gritty of blockchain. Let’s unravel it together and see why it actually matters to you.

Understanding what does fungible mean gives investors, collectors, developers and everyday users a leg up when navigating the often confusing blockchain world.