Fractional Reserve Lending Explained Simply for New Investors

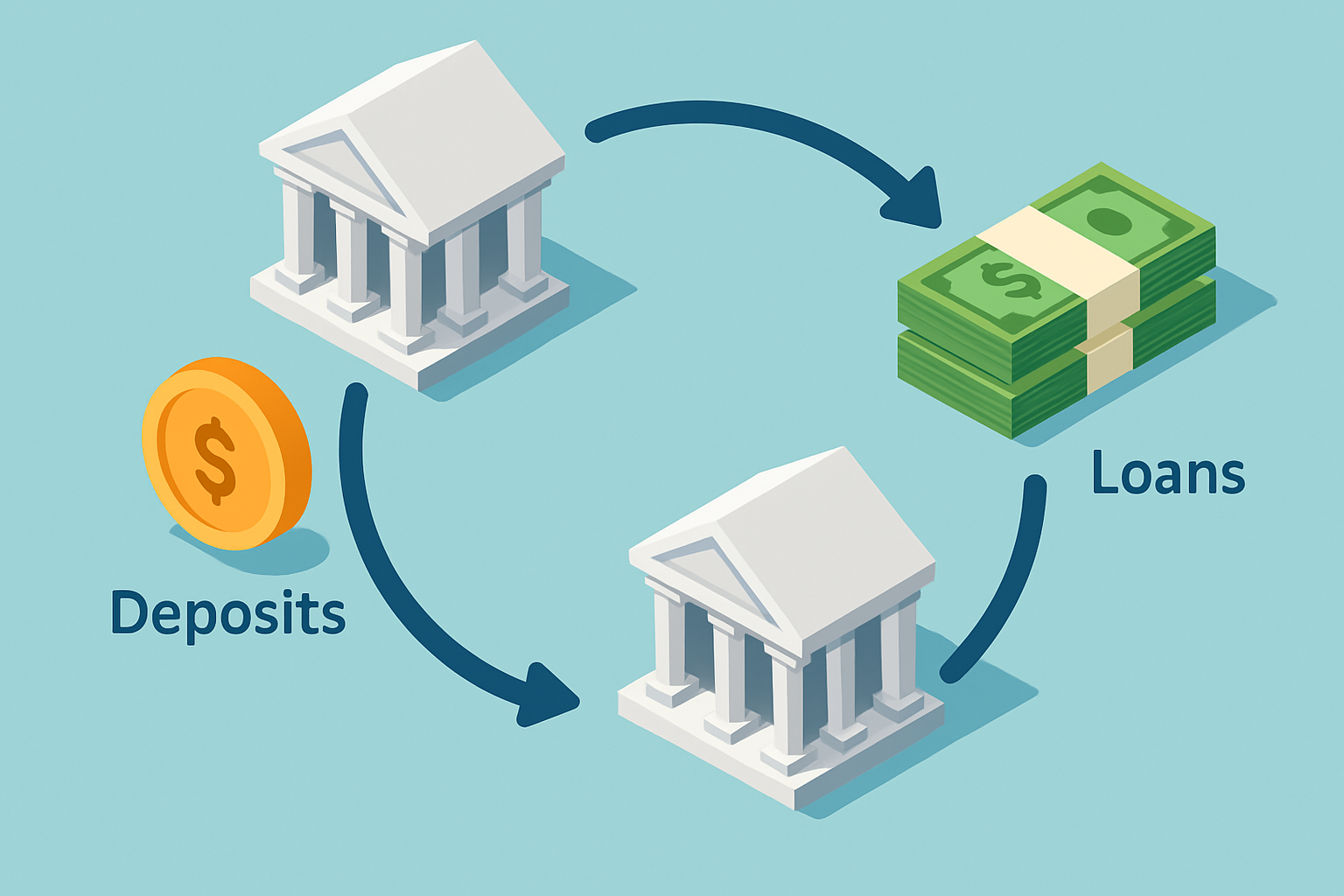

Banks play a key role in the economy through fractional reserve lending, acting as middlemen between savers and borrowers. When individuals deposit their money, the bank isn’t just tucking it away in some vault gathering dust. It lends out a chunk of that cash to individuals, businesses and governments. This lending sparks economic growth by fueling investments, purchases and expansions that keep things moving.

So, What Exactly Is Fractional Reserve Lending Anyway?

Fractional reserve lending is a banking strategy where banks hold just a tiny slice of their customers' deposits as reserves and lend out most of the rest. When you tuck your money away in the bank they keep only a fraction on hand and put the rest to work by handing out loans.

- Banks are required to keep a certain slice of customer deposits as reserves known as the reserve requirement.

- Customer deposits form the bread and butter of the funds banks can lend out.

- When banks hand out loans they’re essentially creating new money in the economy beyond the original deposits.

- The money multiplier effect shows how those initial deposits can grow through multiple rounds of lending like a financial ripple.

- Central banks watch fractional reserve lending to maintain financial stability and keep inflation from running amok.

Picture a community piggy bank where everyone chips in their coins, but the caretaker lends out the bulk of it to neighbors eager to make purchases.

A Down-to-Earth Walkthrough of How Fractional Reserve Lending Actually Works

A customer drops money into their bank account, just like clockwork.

The bank has to stash away a certain chunk of that deposit as reserves.

Then it turns around and lends the rest out to eager borrowers.

Those borrowers go on to use the loaned cash, which often lands in other banks’ coffers.

Those banks don’t miss a beat—they keep the cycle rolling by holding reserves and lending again.

This ongoing loop of deposits and loans quietly but steadily inflates the total money supply, bit by bit.

Imagine you pop down $1,000 into a bank that sticks to a 10% reserve requirement. The bank pockets $100 for safety and loans out $900. That borrower then spends that $900, which quickly lands in someone else's bank account. This second bank holds back $90 and loans out $810. The cycle keeps rolling. Each round sparks new deposits and loans and pushes the money supply higher beyond your original $1,000.

| Cycle | Deposit Amount | Reserve Held (10%) | Loan Amount | Cumulative Money Supply |

|---|---|---|---|---|

| 1 | $1,000 | $100 | $900 | $1,000 |

| 2 | $900 | $90 | $810 | $1,900 |

| 3 | $810 | $81 | $729 | $2,710 |

| 4 | $729 | $72.90 | $656.10 | $3,439 |

| 5 | $656.10 | $65.61 | $590.49 | $4,095.10 |

| 6 | $590.49 | $59.05 | $531.44 | $4,625.59 |

| Here’s a neat little rundown of how money multiplies through successive deposit cycles—each time, the reserve holds its own 10%, setting the stage for the next loan amount to step in. Notice how the cumulative money supply keeps climbing, almost like watching a snowball pick up speed and size down a hill. |

Understanding the Money Multiplier Effect and How Cash Can Grow

The money multiplier is a neat concept that shows how an initial deposit can spark a much bigger boost in the overall money supply thanks to fractional reserve lending. You figure it out by flipping the reserve requirement ratio on its head and taking its inverse. For example, if the reserve requirement is 10%, the money multiplier is 10. That means a single $1,000 deposit could grow into $10,000 through a cycle of repeated lending.

This model is a bit idealized since in the real world things rarely play out so neatly. Banks might hang onto extra reserves to be safe. Borrowers could put off spending and withdrawals happen more often than we would like, all of which tend to chip away at the multiplier’s punch in practice.

"Think of the money multiplier as ripples spreading across a pond: you toss in a single stone (your deposit), and before you know it, those waves start to spread far and wide, gently nudging more money to circulate throughout the economy in expanding circles. It’s a bit like watching a small splash turn into a dance of water—subtle, but surprisingly powerful."

Why Fractional Reserve Lending Really Matters for Investors

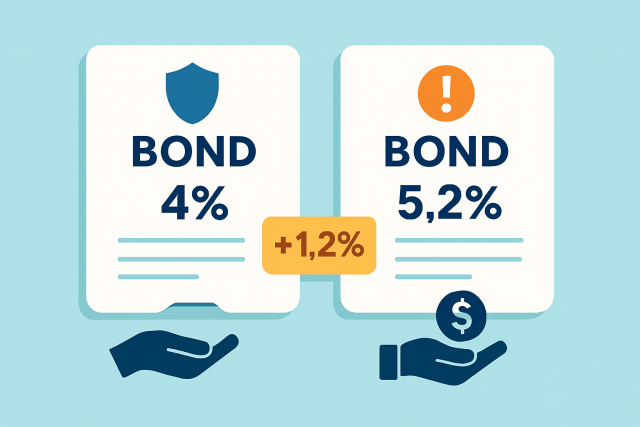

Fractional reserve lending is the backbone of the credit that fuels our entire economic engine. For investors it’s more than just a dry concept—it actually shapes how companies grow and influences interest rates. It is also important for keeping the markets liquid and humming along.

- It offers loans to both businesses and individuals, playing a key role in fueling growth and everyday spending.

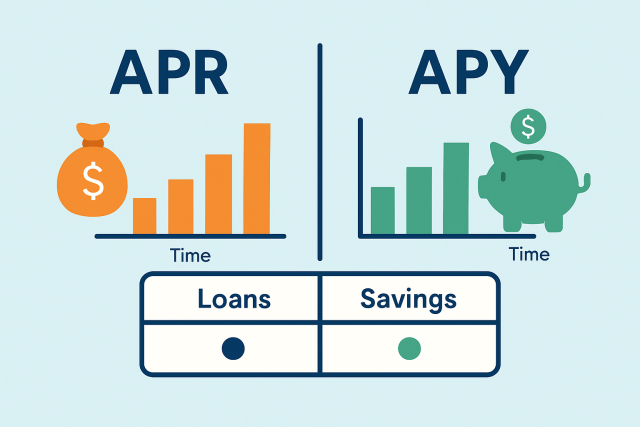

- Changes in lending practices usually set the tone for current interest rates, which then ripple through to affect borrowing costs.

- The volume of lending can nudge inflation up or down by tweaking the overall money supply, more than you might expect.

- Market liquidity often hinges on banks’ lending and deposit activities, making them the unsung heroes behind the scenes.

Understanding fractional reserve lending gives investors a sharper lens to examine banking stocks and interest rate trends along with tricky economic signals.

Risks and Concerns Surrounding Fractional Reserve Lending A Closer Look

Fractional reserve lending usually nudges the economy forward but it’s not without its wrinkles. Banks don’t stash away all deposits as cold hard cash. This can lead to liquidity headaches if many customers decide to withdraw at once. When that happens, bank runs can pop up unexpectedly and shake the foundations of financial stability.

- Liquidity risk occurs when banks don’t have enough cash available to handle surprise withdrawals and face a pinch.

- Bank runs start when depositors lose faith and rush to withdraw their money, turning calm into chaos.

- When banks are too generous with lending, it pushes inflation up by pumping more money into the economy than it can handle.

- Moral hazard appears when banks take big risks because they expect someone else to bail them out if things go south.

- In times of financial turmoil, fractional reserve lending increases the impact of economic shocks by causing the money supply to contract quickly.

Historical events like the Great Depression and the 2007-08 financial crisis really highlight how the chinks in the armor of fractional reserve systems—especially when they are left without proper oversight—can set off some pretty serious economic tumbleweeds.

Rules and Protections

Let's dive into the nuts and bolts that keep everything running smoothly. These rules aren’t just some arbitrary red tape; they’re the backbone of order and fairness, ensuring everyone gets a fair shake. Think of them as the trusty guardrails that keep things from going off the rails. Whether you’re a seasoned pro or just starting out, understanding these protections can save you from headaches down the road. So, buckle up and let’s explore the essentials that make the whole system tick.

Governments put rules in place like reserve requirements and capital adequacy standards and rely on central bank supervision to keep risks in check. Deposit insurance programs pitch in too, shielding customers' funds and helping to keep trust intact—nobody wants a mad rush to pull out their money all at once.

When banks hold enough reserves and capital through fractional reserve lending, regulators play a key role in keeping the risk of insolvency and those dreaded bank runs at bay. This not only protects investors and depositors alike but also keeps the financial system steady and reliable.