Difference Between APR and APY Explained Simply

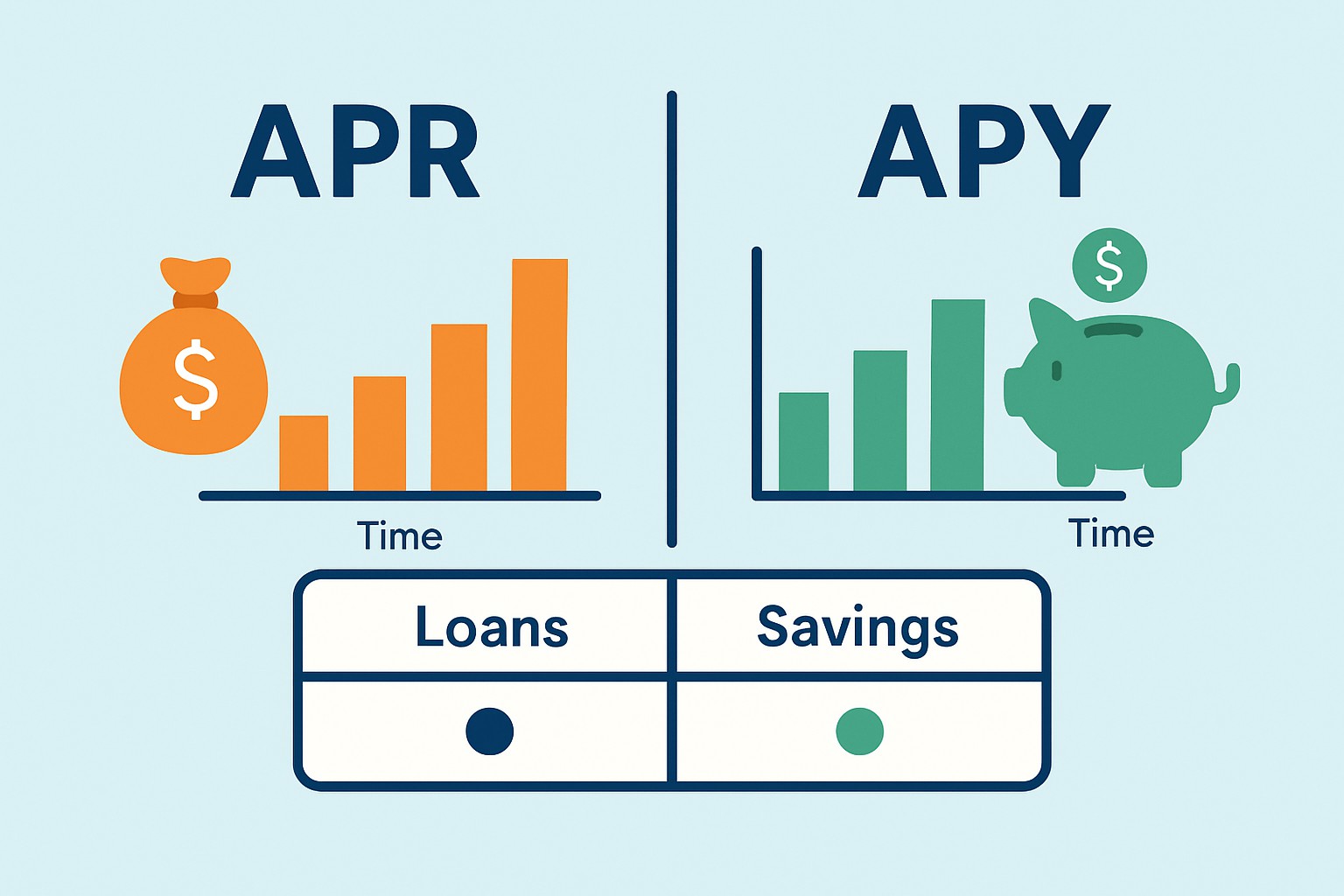

Knowing the difference between APR and APY is important when weighing your options on loans, credit cards, savings accounts or investments. These terms might sound similar and are often used as if they mean the same thing. In reality, they represent different ways of calculating interest and that can make a big difference in how much borrowing actually costs or what you earn on your money.

What Exactly Is APR (Annual Percentage Rate) Anyway

APR or Annual Percentage Rate is the yearly interest rate you pay on borrowed money or earn on investments without getting into compounding details. It’s expressed as a percentage and often appears when discussing loans, mortgages and credit cards. APR combines the nominal interest rate with some fees but doesn’t capture interest-on-interest that can build up over the year.

- APR stands for the simple interest charged or earned over a year, without getting tangled up in compounding.

- It is displayed as an annual percentage rate, keeping things straightforward.

- APR typically wraps in some lender fees, like loan origination or those pesky closing costs.

- People often lean on it to size up the cost of loans and credit cards.

- It doesn’t take into account the way interest can stack up throughout the year.

What Does APY Mean (Annual Percentage Yield) Your Earnings

APY stands for Annual Percentage Yield and shows what your investment or savings account earns over a year once compounding interest kicks in. Unlike APR, APY reveals the actual interest you earn or owe over twelve months assuming interest compounds monthly, daily or quarterly.

- APY factors in how interest compounds throughout the year capturing the full picture.

- It shows the actual return or cost of interest over a whole year with no surprises tucked away.

- APY is expressed as a percentage that truly reflects real growth not just the headline number.

- You’ll often see it used with savings accounts certificates of deposit and various investments.

- APY offers a clearer glimpse of what your money can genuinely earn giving you a better sense of what’s happening behind the scenes.

Understanding the Difference Between APR and APY with a Clear Comparison You Can Actually Use

| Category | APR (Annual Percentage Rate) | APY (Annual Percentage Yield) |

|---|---|---|

| Definition | The stated interest rate plus certain fees over a year – basically what you’re charged upfront plus some extras | The actual interest rate you walk away with after compounding does its magic |

| Interest Calculation | Simple interest calculated without compounding – just straight-up math here | Interest that compounds throughout the year, making your money do a little dance over time |

| Inclusion of Fees | Typically includes some fees like loan origination, so no hidden surprises | Usually excludes fees and focuses purely on the interest you actually earn, nice and clean |

| Role of Compounding | Does not take compounding into account, keeping it straightforward | Reflects compounding intervals like daily or monthly, showing the power of growth in action |

| Common Uses | Mostly used for loans, credit cards, and mortgages – where lenders want to be clear | Commonly seen with savings accounts, CDs, and investments, where growing your stash is the goal |

| What It Means for Borrowers | Gives an estimate of the yearly borrowing cost, so you can budget wisely | Not as relevant here; it’s more about nominal borrowing costs and less about real-world impact |

| What It Means for Savers | Less important; shows the nominal interest rate earned but doesn’t tell the whole story | Shows the real yearly return on deposits – basically, what’s actually hitting your bank account |

The main difference between APR and APY boils down to how they handle compounding and fees. APR shows the straightforward annual cost or earnings without the nitty-gritty of compounding. APY includes compounding, giving you a clearer picture of the actual cost or return—especially over longer periods or when compounding happens frequently.

Think of APR as the loan's upfront rate—basically the sticker price you see right off the bat—and APY as the real cost once the magic (or tricky) effects of compounding kick in. APY reveals the true bottom line, kind of like that final bill you get after all the sneaky fees have had their say.

Why It’s Key for Borrowers and Investors to Truly Understand the Difference

Mixing up APR and APY tends to lead to more financial head-scratchers than most individuals realize. Borrowers might find themselves caught off guard and underestimating how much those costs really add up. Investors and savers could be painting a rosier picture of their gains than what’s actually happening.

- Underestimating the true cost of loans by not fully accounting for how fees sneakily pile up over time.

- Struggling to compare loan offers on a level playing field when APR definitions don’t quite line up.

- Getting a bit blindsided by how slowly savings or investments actually grow if you only look at nominal rates.

- Making investment choices without really wrapping your head around what the actual returns are telling you.

- Running into headaches in financial planning because interest details are murky or just plain missing.

How You Can Easily Figure Out APR and APY Yourself (Without Breaking a Sweat)

Calculating APR and APY can clear the fog when you are sizing up different financial products. APR is usually the straightforward annual rate lenders offer, nothing too fancy. APY factors in how often interest compounds and gives you a clearer picture of what you’re actually earning or paying over the year.

You start with the nominal interest rate and then add any lender fees or charges spread over the life of the loan.

This total is expressed as a yearly percentage rate that gives you a clear snapshot of your borrowing cost before compounding starts.

You kick things off with the nominal interest rate from whatever savings or investment product you’re eyeballing.

You need to pinpoint how often the interest compounds each year and plug those numbers into the formula: APY = (1 + periodic rate)^number of periods - 1. This equation reveals the real effective annual yield, which is what really counts in the end.

Common Misunderstandings and Frequently Asked Questions About APR and APY Clearing Up the Confusion

Handy Tips for Wrangling APR and APY When Choosing Financial Products

Comparing loans, savings accounts or investment products requires looking beyond the headline rate that grabs your attention. Understanding the difference between APR and APY is crucial, as is getting a handle on how fees chip away at the total cost. You also need to know how often interest compounds to make accurate comparisons.

- Make sure you double-check if fees are included in the APR so you don’t get surprised by the loan’s true cost.

- When choosing savings accounts or CDs, watch the APYs to find which one offers the best returns.

- Don’t overlook how often interest compounds because daily compounding usually adds up nicely over time.

- Try using online calculators to convert APRs and APYs into real dollars and cents since it makes everything much clearer.

- Always feel free to ask lenders or banks for a simple explanation of all the fees and precisely how interest is calculated.