What Is a Credit Spread Explained in Simple Terms

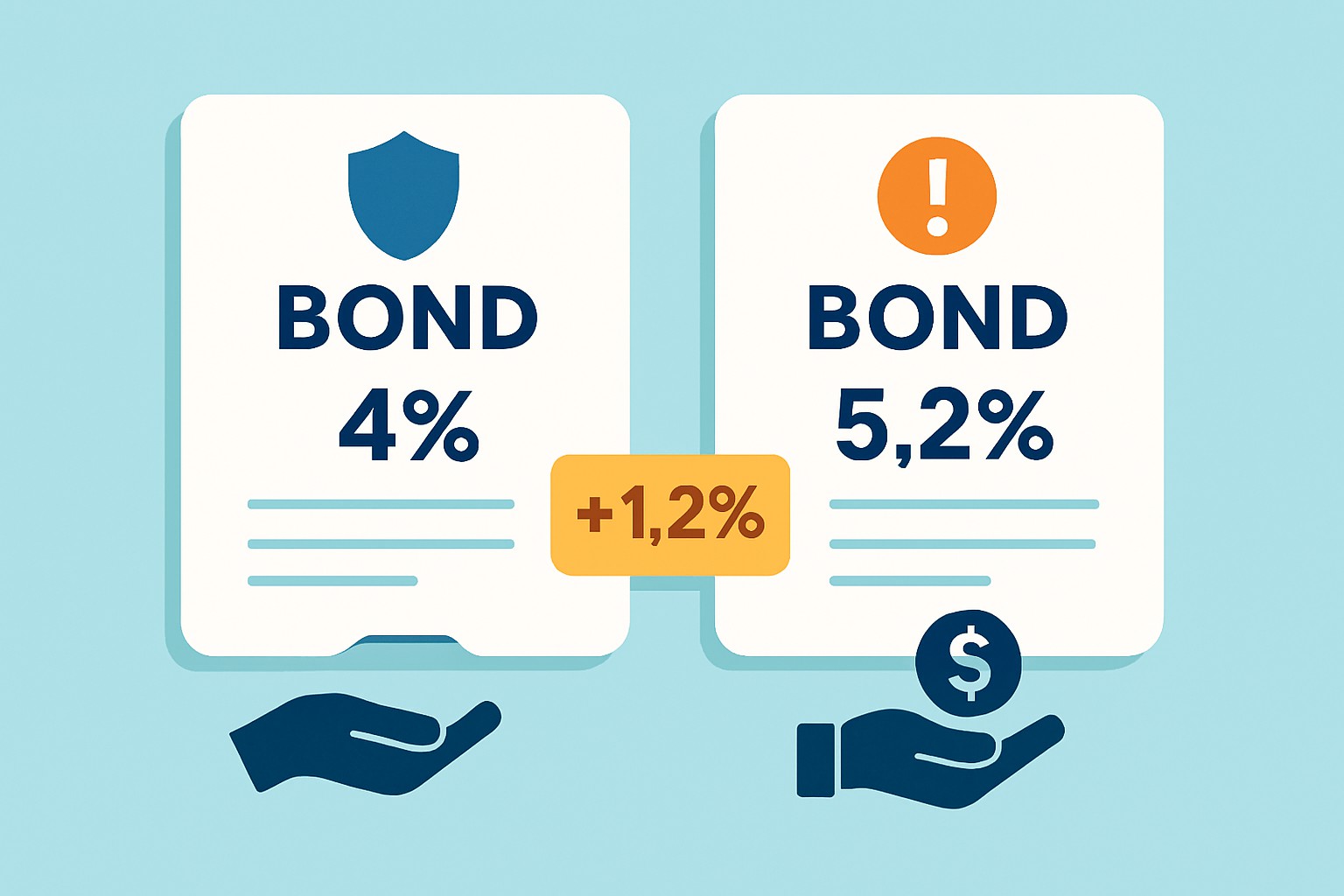

Credit spreads pop up a lot in finance and lending. A credit spread is just the difference in interest rates between two loans or bonds that are pretty similar, except one carries a bit more risk than the other. Think of it as a quick way for investors and lenders to size up just how risky it might be to hand over their money to different borrowers.

What Exactly Does a Credit Spread Mean Anyway?

A credit spread is basically the difference in yield between two bonds or loans that share a similar maturity but differ in credit quality. It shows the extra return investors demand from borrowers who carry a bit more risk compared to their safer counterparts.

- Credit spreads reveal the difference in interest rates or yields between two similar loans or bonds — think of it as the price tag for taking on extra risk.

- The borrower's credit quality plays a big role in shaping how wide that spread ends up being.

- You’ll find credit spreads cropping up in both company-issued bonds and loans banks dish out.

- To make a fair comparison of risk, the maturity periods should be roughly on the same page.

- When you see a wider credit spread it usually rings alarm bells about a higher chance of default or financial bumpiness ahead.

What’s Behind Credit Spreads?

Credit spreads exist because lenders and investors want to be compensated for taking on the extra risk that comes with lending to borrowers who might delay payments or not pay back at all.

Think of credit spreads as that little extra insurance premium investors quietly expect when they’re lending to someone who might be a bit of an unknown quantity — kind of like how a cautious friend would want a bit more on the table before handing over cash to someone they don’t know all that well.

Understanding Credit Spread Measurement

Calculating a credit spread means subtracting the yield of a risk-free bond, usually a U.S. Treasury, from the yield of a riskier bond such as one issued by a corporation.

| Bond Type | Yield (%) | Credit Spread (%) |

|---|---|---|

| Government Bond | 2.0 | — |

| Corporate Bond A | 3.5 | 1.5 |

| Corporate Bond B | 5.0 | 3.0 |

Here’s a straightforward example: the government bond yields a steady 2%. Corporate Bond A sweetens the pot with 3.5%, reflecting a credit spread of 1.5%. Meanwhile, Corporate Bond B is playing it a bit riskier and aiming higher at 5%, with a 3% spread to match—because, as they say, no risk no reward.

Understanding Credit Spreads in Lending and Borrowing

Credit spreads play a vital role in shaping how much borrowers pay when taking out loans. Whether we are talking about personal loans or mortgages or corporate debt, lenders always size up the borrower's credit risk. This shows up as the credit spread and is used to set interest rates.

- Consumer loans usually come with higher interest rates for people with lower credit scores, thanks to those wider credit spreads doing their thing.

- Businesses that aren’t exactly thriving financially tend to get hit with bigger spreads on their loans, pushing their borrowing costs up a notch.

- Mortgage interest rates can creep up when credit spreads shift, especially for borrowers who don’t quite fit into the prime category.

- Credit card companies set their rates based on credit spreads that mirror the risk profiles of their customers.

- When companies roll out bonds, those credit spreads hold the reins in deciding what coupon rates investors come to expect.

Key Elements That Play a Role in Shaping Credit Spreads

Credit spreads widen or narrow based on several factors. These include the overall health of the economy and any upgrades or downgrades to a borrower's credit rating. Market liquidity changes, the borrower's financial condition, and unpredictable global political events also affect risk premiums.

Investors tend to demand higher spreads to compensate for the added risk of default—after all no one likes to gamble blindly.

A drop in a borrower's credit rating usually leads to wider credit spreads and signals that individuals are growing uneasy about their ability to make repayments.

Bonds become tougher to offload when market liquidity tightens. This often pushes spreads higher—like trying to sell ice to an Eskimo but in finance.

Warnings about company earnings or weak financial reports often cause credit spreads to widen as investors start sweating a little.

Geopolitical instability or unexpected global events ratchet up uncertainty and nudge spreads higher across markets—because when the world throws curveballs markets tend to bat cautiously.

Frequent Misunderstandings About Credit Spreads That Often Trip Individuals Up

Credit spreads can often trip up newcomers to the subject. Some individuals assume a credit spread is simply the total interest rate or that spreads hold steady over time. Others think they’re only relevant when talking about bonds.

- The credit spread shows the extra yield you get on top of a risk-free asset instead of the entire interest cost added on.

- Credit spreads can be quite restless and shift often depending on market sentiment or the borrower's situation.

- Although they are usually discussed in the context of bonds, credit spreads also appear in loans, credit derivatives and other debt instruments.

- A wider credit spread does not automatically mean a default is near. It can simply reflect jitters or temporary worries in the market.

- Even "risk-free" government bonds carry some risk like inflation creeping in, so the term is not absolutely fixed.

Practical Example Explaining Credit Spread With a Simple Scenario That’s Easy to Grasp

Imagine lending money to two people: a close friend who always pays you back on the dot and a total stranger with no credit history or reputation. Since you trust your friend, you’d probably lend them the cash without extra interest. For the stranger who feels like a wild card, you’d likely want to charge more interest to cover the risk they might not come through.

How Investors and Lenders Typically Use Credit Spreads (and Why They Care)

Credit spreads play a key role for investors and lenders when sizing up risk and steering their financial decisions. By keeping tabs on these spreads they can price loans and bonds with more precision, manage their investments smarter and catch a glimpse of the bigger economic picture.

- Size up the credit risk borrowers carry before diving into loan or bond investments. It is a vital first step you do not want to overlook.

- Pin down the right loan pricing that finds a solid balance between chasing returns and keeping risk in check.

- Keep a sharp eye on credit spreads because they often hint at changes in the economy and investor sentiment.

- Weigh your investment options by comparing relative credit spreads to discover where the real value lies.

- Use credit derivatives as a toolkit to hedge against the ups and downs caused by shifts in credit spreads, acting like an insurance policy for your investments.