What Is Aave and How It Works in DeFi?

If you're wondering what is Aave, it really shines as one of the most popular decentralized finance (DeFi) platforms out there, giving individuals the chance to lend and borrow cryptocurrencies without having to go through the usual banking hoops.

Decentralized Finance or DeFi as the cool kids call it is shaking up how we view financial services by leveraging blockchain technology to enable lending, borrowing, trading and saving without having to go through usual middlemen like banks. Protocols such as Aave let users jump straight into financial products via smart contracts. This makes the whole system feel more accessible, transparent and genuinely open to anyone with a bit of internet savvy.

What Is Aave? A Simple Explanation That Cuts Through the Noise

Aave is a decentralized protocol that lets anyone lend or borrow cryptocurrencies without the usual runaround from banks. Launched in 2017 by Stani Kulechov, it has been quietly shaking up the financial world ever since. The name Aave means "ghost" in Finnish and perfectly captures the spirit of its transparent and user-driven system that operates openly on the blockchain.

- Aave is a decentralized lending platform that cuts out banks and makes peer-to-peer lending feel like swapping stories with a friend rather than dealing with a faceless institution.

- It runs on an open-source protocol that keeps things transparent and helps build a sense of community trust—something we all appreciate more these days.

- Users stay firmly in the driver's seat of their funds because it’s non-custodial and no sneaky third parties hold onto your assets behind the scenes.

- Aave offers stable and variable interest rate options catering to all kinds of borrower preferences—like choosing between a smooth ride or a bit of a rollercoaster.

- It also boasts clever flash loans that let you borrow instantly and unsecured within a single blockchain transaction—pretty nifty when you need speed without the usual fuss.

Aave caters to all sorts of people—from crypto enthusiasts looking to make a little passive income by lending out their assets, to borrowers who want fast access to cash without the usual hassle of credit checks. Since it’s open and permissionless, pretty much anyone can jump in from wherever they happen to be.

Aave Basics You Should Know

Using Aave is pretty straightforward. Users deposit cryptocurrency as collateral which lets them earn interest and opens the door to borrowing power. Then borrowers can tap into that collateral to take out loans in various crypto assets. Behind the scenes all these transactions are powered by smart contracts that manage lending, borrowing and repayments automatically.

- Deposit any supported cryptocurrency you fancy into Aave's lending pool and start watching your interest grow, almost like planting a money tree.

- Sit back and passively earn interest as other users take out loans against the assets you have stashed—it’s kind of like being the bank, without the fancy suits.

- Borrow what you need by putting up collateral and picking between variable or stable interest rate loans that suit your style.

- Keep up with interest payments on your borrowed funds as agreed in the loan terms—nothing too tricky if you stay on top of it.

- If your collateral value takes a nosedive, Aave’s liquidation system will step in and sell a part of it to keep the loan risk in check—it’s their way of keeping things from going sideways.

A Quick Dive into the Nitty-Gritty

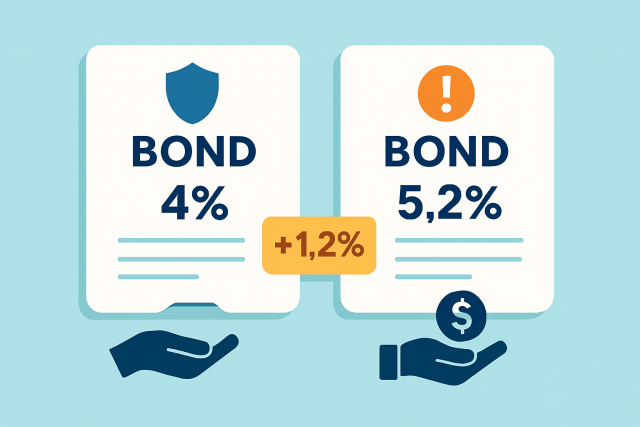

Aave offers two flavors of interest rates: stable and variable. The stable rate keeps things steady and predictable to make payments easier to plan. The variable rate dances with market demand, sometimes lowering your costs but bringing more uncertainty to the party.

Understanding the Nuts and Bolts of Collateral and Liquidation

Collateral is basically the crypto you put up front when you want to borrow other assets. Aave uses something called a health factor to keep an eye on how solid your loan really is. If your collateral’s value takes a nosedive, the platform might swoop in and liquidate a bit to keep lenders from getting the short end of the stick. This whole system usually keeps borrowing on the safe side.

Flash Loans That Turn Heads

Flash loans let you borrow any amount on the spot without having to stash away collateral, as long as you settle up within the same transaction.

Flash loans are a pretty powerful tool in the DeFi toolbox. Sure, they’re a bit complex at first glance, but once you get the hang of the basics, you’ll see they unlock some seriously innovative opportunities—showing off the real magic of decentralized finance.

Getting Started with Aave A Friendly Guide for Those Just Diving In

Starting with Aave is easier than you might think. In just a few steps you can link your wallet and deposit assets, then jump right into lending or borrowing.

Start picking a crypto wallet that plays nice with the platform—something like MetaMask or Coinbase Wallet usually does the trick—and be sure to lock down your setup like Fort Knox.

Swing by Aave’s official website and connect your wallet to jump right into the action.

Deposit the cryptocurrencies that Aave supports into its lending pools so you can start raking in some interest—it’s kind of like planting seeds and watching them grow.

If borrowing is more your style, you’ll want to put up some collateral and then carefully pick the asset and loan amount that suit your needs.

Keep a close eye on your "health factor" every now and then to dodge liquidation or any nasty surprises—because nobody likes waking up to that kind of headache.

Start with just a small amount while you get the hang of the risks involved—it’s better to test the waters before diving in headfirst. Be patient with yourself as you learn the ropes, and don’t hesitate to lean on community resources for a bit of extra support.

Potential Risks and Things to Keep in Mind When Using Aave

- Smart contract bugs or exploits might put funds at risk which is always a bit of a nail-biter.

- A chance of liquidation exists if the collateral value takes a nosedive and this can lead to unwelcome losses.

- Cryptocurrency price swings tend to shake up loan conditions and the stability of your collateral. It’s a wild ride at times.

- Platform fees including pesky Ethereum network gas costs can chip away at your overall profitability more than you might expect.

- User mistakes like sending funds to the wrong address or getting tripped up by confusing terms remain a perennial headache.

Aave’s community and developers are constantly rolling up their sleeves to review the protocol and nip risks in the bud. Users are rightly encouraged to stay informed, stick to secure wallets and keep a vigilant eye on their loans.

Taking a Closer Look at What’s Next for Aave and the World of DeFi Lending

For those wondering what is Aave, the protocol keeps rolling out fresh features like cross-chain lending and liquidity mining rewards. It has beefed-up Layer 2 integrations that aim to shave off costs.