What Is Proof of Stake and How Does It Work?

Proof of Stake (PoS) is a fundamental consensus method used in blockchain networks to confirm transactions and keep everything secure without using huge amounts of energy. Rather than relying on old-school power-hungry techniques, PoS chooses validators based on how much cryptocurrency they hold and lock up as a stake. Basically, they put their money where their mouth is to encourage honest behavior.

What Exactly Does Proof of Stake Mean Anyway

Proof of Stake is a consensus method where validators get picked to create new blocks not by cracking tough puzzles but based on how much cryptocurrency they have locked up as their "stake." Think of it like putting down a security deposit or holding voting power—the bigger your stake the better your shot at being chosen to add the next block and rake in the rewards.

Proof of Stake takes a different route compared to Proof of Work which has miners burning through heaps of energy just to race at solving puzzles. Instead Proof of Stake picks its validators based on how much stake they hold, not by who’s got the biggest computing muscle. This shift usually makes the blockchain more accessible and friendlier to the environment.

- Validator selection usually hinges on how much cryptocurrency is staked and functions like a weighted lottery where the more you put in the better your chances.

- Participants have to lock up their tokens as a security deposit that keeps them honest and shows they’re in it for the long haul.

- Validators earn rewards for confirming valid transactions but risk penalties or getting "slashed" if they step out of line or act shady.

- PoS slashes energy consumption dramatically compared to PoW which is a big win for anyone rooting for the environment.

- The whole system is built to maintain decentralization by making it easier for more people to join without the headache of expensive hardware setups.

What Is Proof of Stake and How Does It Work, Anyway?

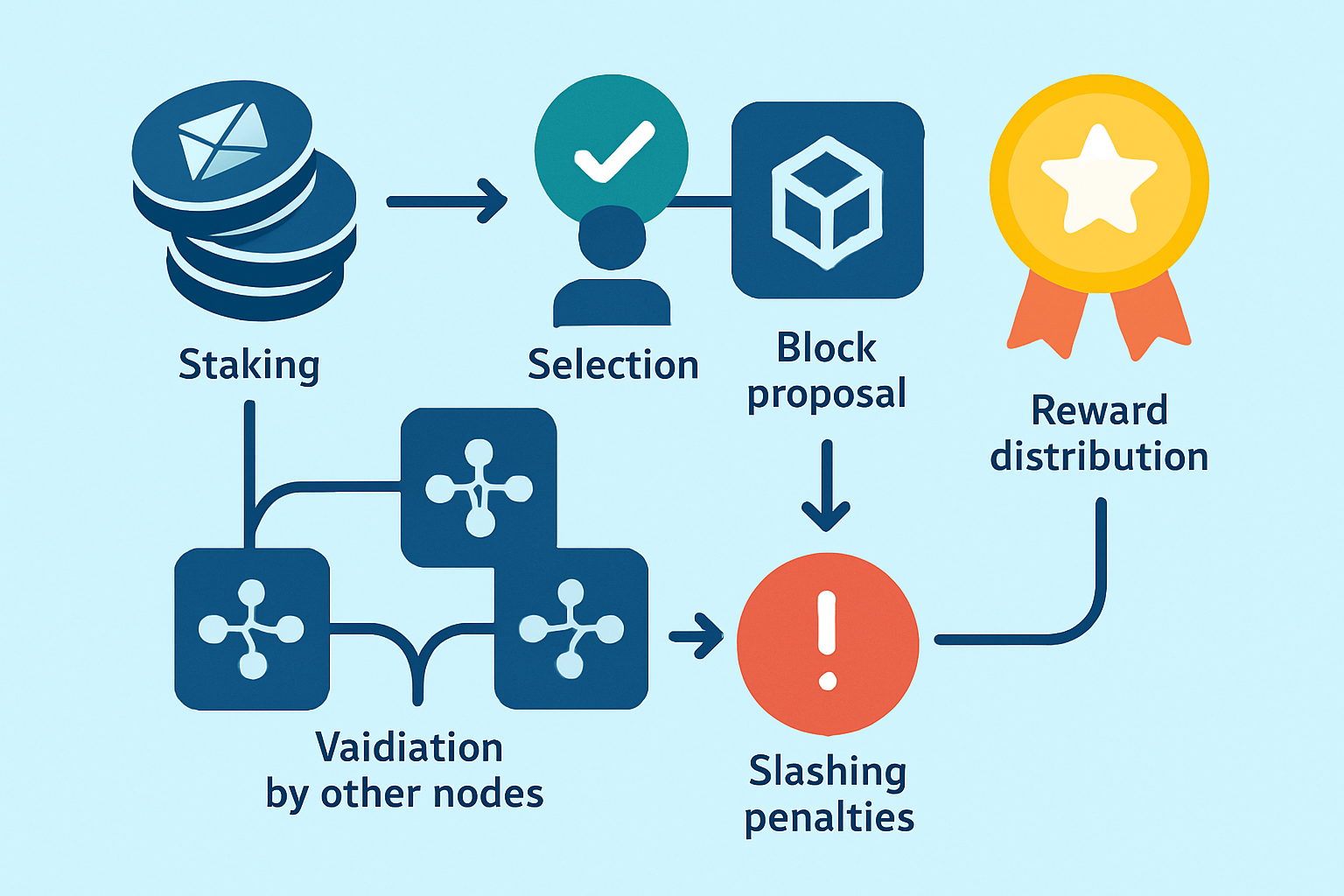

Proof of Stake works by picking validators who lock up their tokens, then gives them the chance to propose and confirm new blocks on the blockchain. This way of choosing validators nudges them toward playing fair—rewarding the good apples and giving a cold shoulder to the rule-breakers.

Validators put up a certain amount of cryptocurrency as a stake to join the action.

The network picks a validator at random to suggest the next block, usually favoring those who've staked more.

Other validators check that proposed block carefully to confirm it’s valid.

Once everyone agrees, honest validators get their rewards while dishonest ones face penalties.

Validator roles shuffle regularly to keep things fair and secure the network tightly.

Staking is basically locking up your tokens to earn the privilege of taking part in the network's activities. Slashing serves as a tough-love penalty for validators who step out of line and ensures the system stays secure.

Different Versions and Uses of Proof of Stake (with a Few Twists Along the Way)

Various blockchains put their own unique spin on Proof of Stake and aim to boost performance and governance. You’ll often hear about flavors like Delegated Proof of Stake (DPoS), Liquid Proof of Stake (LPoS) and Nominated Proof of Stake (NPoS) each bringing its own twist on delegation and how validators get picked.

| PoS Variant | Example Blockchains | Validator Selection Method | Role of Delegation | Main Benefits | Trade-Offs |

|---|---|---|---|---|---|

| Classic PoS | Ethereum 2.0, Cardano | Validators get picked through a weighted lottery based on how many tokens they’ve staked — it’s a bit like a lottery, but your chances depend on your investment | Delegation is usually optional and generally reserved for those trusted few | Energy efficient, secure, and keeps things nicely decentralized | Requires a minimum stake and can sometimes lean towards centralization, sadly |

| Delegated PoS (DPoS) | EOS, TRON | Token holders roll up their sleeves and vote to elect a fixed set of validators | Delegation really takes center stage here, driving how the whole system ticks | Boasts faster transaction speeds and can handle more throughput | Validator group often ends up more centralized, for better or worse |

| Liquid PoS (LPoS) | Tezos | Validators sort of pick themselves, with delegation flowing freely and constantly | Delegation is an ongoing dance, making it simple to move your support around | Offers flexible delegation and opens doors to more accessibility | Governance can get a bit tricky to navigate, like herding cats sometimes |

| Nominated PoS (NPoS) | Polkadot | Nominators back validators; who gets chosen depends on both the nominations and the stake involved | Delegation happens through nominators stepping in | Finds a nice middle ground between decentralization and security | Demands that nominators stay actively involved, keeping their eyes peeled |

Ethereum 2.0 made the leap from the energy-guzzling Proof of Work to the classic PoS. This aims to ramp up scalability and reduce its environmental footprint. Cardano sticks to a strict PoS model leaning heavily on academic research and formal verification to keep security tight—no cutting corners there. Meanwhile, Polkadot takes a different route with Nominated Proof of Stake (NPoS) where nominators back validators they trust creating a blend of community governance and security incentives.

Benefits of Proof of Stake

Let's dive into the perks of Proof of Stake, a consensus mechanism that’s really been turning heads. If you’re tired of the usual energy-guzzling setups, this one’s a breath of fresh air. Not only does it trim down the carbon footprint, but it also speeds things up on the blockchain front. And the best part? It often feels more democratic, giving more people a fair shot at participating without needing a supercomputer tucked under their desk. It’s like the cool, efficient cousin in the crypto family—definitely worth getting to know better.

- Proof of Stake cuts down energy use by a mile and gives blockchain networks a much-needed boost in sustainability. It’s a real game changer for the planet.

- It delivers faster transaction speeds and scales better than the old-school mining-based setups we’ve been used to.

- With lower hardware and setup costs more validators from around the globe can join in, encouraging a wider, more diverse community.

- Validation rights get spread out among stakers so PoS usually keeps the nasty centralization headaches of Proof of Work at bay.

- Transactions also tend to wrap up quicker, making these networks far more suited to our everyday hustle and bustle.

These benefits truly make Proof of Stake a big leap forward for blockchain adoption by tackling many longstanding headaches of Proof of Work such as sky-high electricity bills and the need for pricey mining rigs. By lowering the barriers to entry, PoS invites more people into the network which supports decentralization and beefs up security.

Proof of Stake works by having shareholders cast their votes to protect their company’s interests, rather than miners scrambling to solve complex puzzles. It’s generally seen as a cleaner, more efficient way to keep blockchains secure—kind to the environment too, which is a refreshing change if you ask me.

Challenges and Criticisms Surrounding Proof of Stake the Insider’s Look

- When wealth piles up in the hands of a few, those big players often end up calling the shots sometimes more than you would expect.

- The "nothing-at-stake" dilemma pops up when validators back conflicting chains without paying a price and can really stir the pot in risky ways.

- Staking pools that hog the validation spotlight tend to push the network toward centralization which isn’t ideal.

- When validators start teaming up behind the scenes it can seriously shake trust in consensus by their sneaky coordination.

- Handing out meaningful penalties to the troublemakers really hinges on having a solid protocol design and a community that’s on the ball.

Proof of Stake brings plenty to the table yet blockchain communities are still hustling to tackle its quirks and challenges. Many PoS protocols throw in slashing mechanisms and some pretty elaborate validator selection processes to keep risks like the notorious nothing-at-stake problem and collusion at bay.

Getting Your Feet Wet with Proof of Stake Networks

People looking to jump into PoS networks have two main paths: becoming validators or delegators by staking their tokens. They’ll need to clear the minimum stake bar and get compatible wallets. If they are aiming for the validator role, they’ll also have to run nodes. Many prefer to simply delegate their stake to trusted validators via staking pools.

Pick up the native cryptocurrency for the PoS network you’re eager to join.

Set up a wallet that’s not just any wallet but one that plays nice with staking and your chosen blockchain.

Stake your tokens by locking them up according to the network’s minimum requirements.

Choose either to run your own validator node if you’re feeling adventurous or delegate your stake to a trusted staking pool and let the pros handle the heavy lifting.

Keep a sharp eye on your staking rewards and stay in the loop about any network updates or penalties because nobody likes surprises when their crypto is on the line.

Beginners usually find it pays off to dig into staking pools and size up validator reputations before jumping in. Dodging scams and dodgy operators can save you a lot of headaches later on. It’s important to understand the risks involved like slashing penalties if a validator steps out of line and to keep your private keys locked down tight.

Looking Ahead at Proof of Stake and What’s on the Horizon

Proof of Stake is evolving at a brisk pace with fresh developments focused on ramping up scalability and tightening security to make the whole user experience smoother. Hybrid consensus models blending PoS with other techniques are currently being put through their paces to boost network resilience.

Increasing regulatory scrutiny and rising environmental concerns appear to be nudging more blockchains toward embracing proof of stake or similar approaches—options that not only offer a greener footprint but also check the boxes for compliance more neatly than the old-fashioned mining methods.